Many American employees are optimistic about theirs retirement goalshowever most consider it is going to be a problem for them retire comfortably.

Nearly half, 44%, of these working in new CNBC poll are “cautiously optimistic” about their means to achieve their retirement targets, and 27% say they’re “real looking” about that occuring.

Nevertheless, 82% of employees on this survey say attaining a snug retirement is “a lot tougher or considerably tougher” to realize than it was for his or her mother and father. A majority, 69 %, are involved about whether or not they are going to be capable of afford to cease working or retire fully, and 80 % fear that Social Safety will not be sufficient to stay on after retirement.

The CNBC report, produced by SurveyMonkey, surveyed 6,657 American adults, together with 2,603 retirees and 4,054 who work full-time or part-time, are self-employed or personal a enterprise.

The decline of conventional pensions, rising well being care prices and elevated life expectancy have contributed to the necessity for employees to rethink their retirement plans.

“Retirement itself is retiring,” stated Joseph Coughlin, director of the MIT AgeLab. “Typically inside a yr, two years, they discover that, frankly, they both want more cash or they should do one thing.”

Listed here are good strikes you may make at any age to make your retirement targets simpler to realize:

In your 20s and 30s: Enhance financial savings with tax benefits

Many youthful employees within the CNBC ballot — together with 43 % of Gen Z and millennials, who’re between the ages of 20 and 40 — are “cautiously optimistic” about their means to satisfy their retirement targets.

For individuals of their 20s and 30s, “retirement” is a great distance off and means having the monetary freedom to “work as a result of we need to, not essentially as a result of we now have to,” stated licensed monetary planner Rianka Dorseinville, founding father of YGC Wealth in Lanham, Md., and a CNBC’s Board of Financial Advisors member.

Beginning to invest for early retirementparticularly in tax-advantaged accounts, helps you profit from your time investing out there and make the most of power of compound interest.

Totally different job alternatives can provide flexibility in saving choices for the longer term. Many individuals of their 20s may go 9 to five and have a “aspect gig” or part-time job within the evenings or on the weekends.

Which means it can save you in a 401(okay) plan at work in addition to a self-employed retirement plan, resembling a Simplified Worker Retirement Account – Particular person Retirement Account or Solo 401(okay) by yourself, stated Nate Hoskin, CERT monetary planner and founding father of Hoskin Capital in Denver.

Whereas you could have opened a 401(okay) plan at your first job, intention to develop the percentage you contribute yearly. Put in a minimum of sufficient cash to receive the full company contribution.

Conventional IRA and 401(okay) plans offer you an upfront tax break. Making contributions with pre-tax cash lowers your taxable revenue now, however you may must pay taxes while you withdraw the cash in retirement at your future tax fee.

Roth accounts that assist you to deposit after-tax dollars which then develop and may be withdrawn at retirement tax-free, will also be a wise wager for younger employees who qualify.

Lordhenrivoton | E+ | Getty Photographs

Within the 40s: Look ahead to rising prices

When you’re in your peak incomes years, bills may also add up shortly. About half, 52 %, of Millennials and 47 % of Gen Xers within the CNBC ballot stated “paying off debt or loans” is the primary purpose they really feel behind of their retirement planning or financial savings.

In that case, “it is in all probability time to reevaluate monetary targets,” Dorsainville stated. Deal with paying off bank card debt and excessive rates of interest increasing your emergency savings so you are not pressured to dip into retirement financial savings for sudden bills.

Additionally, watch out for “way of life creep.” You do not have to spend extra simply since you make extra. Do not let your way of life bills develop quicker than your revenue. See what bills you’ll be able to reduce or cease.

In your 50s: Estimate your retirement revenue

The CNBC survey discovered that 48 % of GenXers hope to have saved $500,000 or extra for retirement, however the identical share at present have $50,000 or much less saved. Practically 20% of this age group are “undecided” how a lot cash they might want to spend every year on dwelling bills and different purchases after retirement.

In your 50s, it is time to ramp up your financial savings and begin crunching the numbers to find out how a lot revenue you may have in retirement.

“Not sufficient individuals truly do monetary planning, so they are not conscious of the numbers they’re going through early sufficient,” stated Catherine Vallega, CFP and founding father of Inexperienced Bee Advisory in Winchester, Massachusetts.

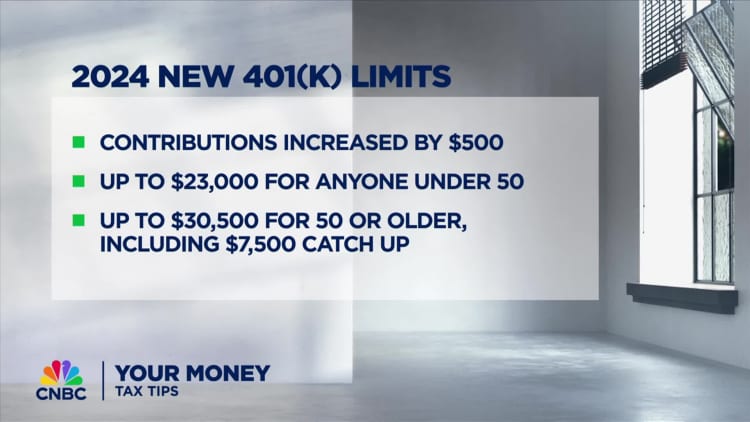

Beginning at age 50, you’ll be able to improve your retirement financial savings by “catch-up” installments. In 2024, the utmost you’ll be able to contribute to a 401(okay) is $23,000, however the IRS permits you to add an extra $7,500 if you happen to’re 50 or older. For an Particular person Retirement Account (IRA), the utmost contribution for 2024 is $7,000, with an extra $1,000 if you happen to’re 50 or older.

On-line calculators can present you ways a lot your retirement financial savings can develop between now and your anticipated retirement, and the way a lot that stability can present in month-to-month revenue. Additionally take into account how much money you can get from Social Security.

Even if you happen to suppose you are behind on saving, evaluating your retirement revenue offers a chance to determine learn how to make it work, Vallega stated.

“We’re not going to relaxation on what you have completed prior to now. Let’s begin as we speak with what we now have,” she stated. “What are our belongings? What are our income-generating capabilities? After which we’ll transfer ahead.”

In your 60s: check your retirement

Shapecharge | E+ | Getty Photographs

Whereas 38 % of child boomers of their 60s and 70s say they’re “maintaining with retirement plans and financial savings,” in response to the CNBC survey, 41 % say they’re “not on time.”

As you enter your 60s and are nearer to retirement, take your retirement for a check drive. Take into consideration what you are going to do, who you are going to do it with, and the place you are going to do it.

For instance, Coughlin stated to ask your self, “What are you going to do each Tuesday? There shall be many Tuesdays with bills, challenges, and alternatives.”

Many individuals as we speak live into their 90s and beyond. Whereas touring, pursuing hobbies and pursuits, and spending time with household are what most individuals of all ages say they might “ideally” do after retirement, the CNBC survey discovered that those that thought they might “realistically ” will be capable of do it, they’re much much less.

As soon as you have decided your aspirations, do a way of life and site check. Use your break day from work to pursue actions you suppose you’d love to do and trip within the locations you suppose you’d prefer to stay. Additionally, check your retirement finances by evaluating housing, transportation, meals, leisure and healthcare prices in that space to what you pay now. See if you happen to can stick with this new finances for just a few months whilst you’re nonetheless working.

No matter your age, Hoskin stated, stick with some primary guidelines to realize monetary safety: “You continue to must spend lower than you make, save a good portion of your revenue, put that cash in the best accounts, and to take a position them for the longer term,” he stated. “That is the cycle that creates generational wealth.”

SIGN UP: Money 101 is an eight-week monetary freedom coaching course delivered weekly to your inbox. Join here Additionally it is accessible in Spanish.

REGISTER NOW! Be a part of CNBC’s free, digital Ladies and Wealth occasion on September 25 to listen to from monetary specialists who will assist you fund your future—whether or not you are returning to the workforce, beginning a brand new profession, or simply trying to enhance your relationship with the cash. Join here.