A gaggle of Tiburon residents is combating to get again property that Marin County mistakenly bought at a tax public sale.

The customer, a restricted legal responsibility firm referred to as AssetRenew, picked up the cargo for $6,600. Now the corporate desires the Tiburon View Owners Affiliation to pay $1 million to get it again or pay hire to make use of it.

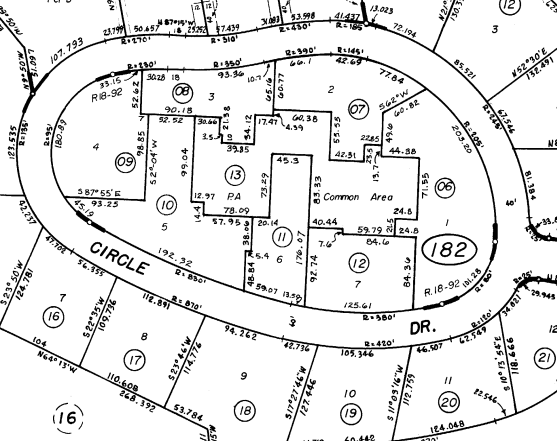

The lot is a standard space that features a pool, recreation space and laundry services for seven affiliation members residing on heaps surrounding the Circle Drive property. The county bought it at public public sale in March as a result of the affiliation owed $625 in unpaid taxes and $981 in penalties for the years 2013-2018.

“We acknowledge that that is mistaken and ought to be reversed,” mentioned Sandra Cacharos, the county’s assistant finance director. “Now we have requested the client to voluntarily withdraw, which is step one within the authorized course of. Nevertheless, they indicated that this was not their intention.

A cellphone name to AssetRenew elicited this response from an individual who didn’t supply identification: “I haven’t got a solution. I am not allowed to speak about it.

In a letter to the county, affiliation legal professional Richard Zuromski wrote, “Director Derek Leffers of Aptos, California, focuses on shopping for properties at tax gross sales to benefit from conditions like this one.”

“Certainly, after the acquisition of the widespread lot, the client, by way of Mr. Leffers, demanded cost of over $1 million for the widespread lot,” Zuromski wrote.

In his e-mail, Zuromski mentioned AssetRenew “held the affiliation hostage to a ‘hire’ for the widespread lot when the CC&Rs clearly present that the affiliation and its members have an easement over the widespread lot as a part of their possession of the heaps.” “

He wrote that Leffers “threatened to ‘kick’ the affiliation off the widespread lot if his calls for weren’t met.”

In an unsigned letter to county supervisors, AssetRenew mentioned, “We imagine the Tiburon View Owners Affiliation’s letter is deceptive and false in some areas.”

The letter said that AssetRenew had acquired “a number of different presents” for the property and that the affiliation “might purchase the property again on the open market if it wished.”

“Now we have to incur important prices coping with this,” the letter mentioned, “and we’re reaching out to the Board to know this course of.”

The sale was delinquent in county property taxes.

“The full acreage is assigned an assessed worth of $1 as a result of the precise worth of that acreage is distributed among the many particular person lot house owners,” Cacharos mentioned.

Nevertheless, for the reason that widespread space acquired an evaluation parcel quantity, 034-182-13, to determine it, different taxing businesses licensed by poll measures and different rules have filed direct levies. Direct costs could also be collected from the county tax on behalf of a taxing company concurrently different county property taxes.

The Belvedere Tiburon Library, the Marin Emergency Radio Authority and the San Francisco Bay Space Restoration Authority submitted modest direct charges to the toll collector to pay for the widespread.

In keeping with Zuromski, the tax invoice for the widespread space was initially despatched to the affiliation’s supervisor, Bayside Administration and Leasing, who paid it together with the tax payments for the opposite seven affiliation members.

Bayside Administration moved its workplace from Mill Valley to Sausalito in 2010. and the corporate despatched a change of tackle discover to the U.S. Postal Service, Zuromski wrote.

“For causes unknown to the affiliation, the tax invoice for the widespread lot was not forwarded to the brand new Bayside tackle,” he wrote.

Cacharos mentioned that beneath state legislation, a discover from the U.S. Postal Service doesn’t change an tackle for tax functions. The proprietor of report should file a change of tackle with the county choose.

Zuromski additionally doubts whether or not the tax collector accurately seen the connection to the tax sale. State legislation requires the tax collector to “ship discover of the proposed sale by registered mail with return receipt requested to the final identified mailing tackle, if out there, of the events” and to “make affordable efforts to acquire the identify and final identified mailing tackle of the events nations,” he wrote in his letter.

“At no time was the affiliation, any of its members or the administration firm notified of this tax sale,” he wrote.

The county discovered that the tax sale disadvantaged the Tiburon View Owners Affiliation of due course of and violated a state legislation that prohibits widespread areas from being the only real topic of liens for property taxes. In consequence, the sale is void and ought to be put aside, the county concluded.

County supervisors authorized the repeal Nov. 5. Nevertheless, Cacharos mentioned the approval was contingent on AssetRenew’s cooperation. She mentioned that since AssetRenew has declined to assist reversing the sale, the following step shall be to take the matter to the Board of Supervisors for a listening to. This has not but been scheduled.

The county tax official is required to supply on the market property with delinquent taxes when the age of delinquency exceeds 5 years. From fiscal years 2017-18 by way of 2023-24, 51 Marin properties have been bought at tax gross sales.

Cacharos mentioned when she does tax gross sales, her division focuses on properties which have properties on them and does every part it could actually to assist house owners maintain their properties. The tax sale at which the Tiburon Widespread was bought included 109 properties, together with seven residences. No bids have been acquired for 89 of the plots, and 10 vacant plots have been bought.

“We saved all of the residences,” Cacharos mentioned.

The tax collector is reevaluating how widespread areas are dealt with on property tax rolls to forestall such errors.