Enterprise in the US has been warning for months that they are going to elevate the costs of its prospects in response to President Trump’s tariffs.

Current knowledge present that this occurs solely in a restricted manner up to now, serving to to keep up a lid of inflation.

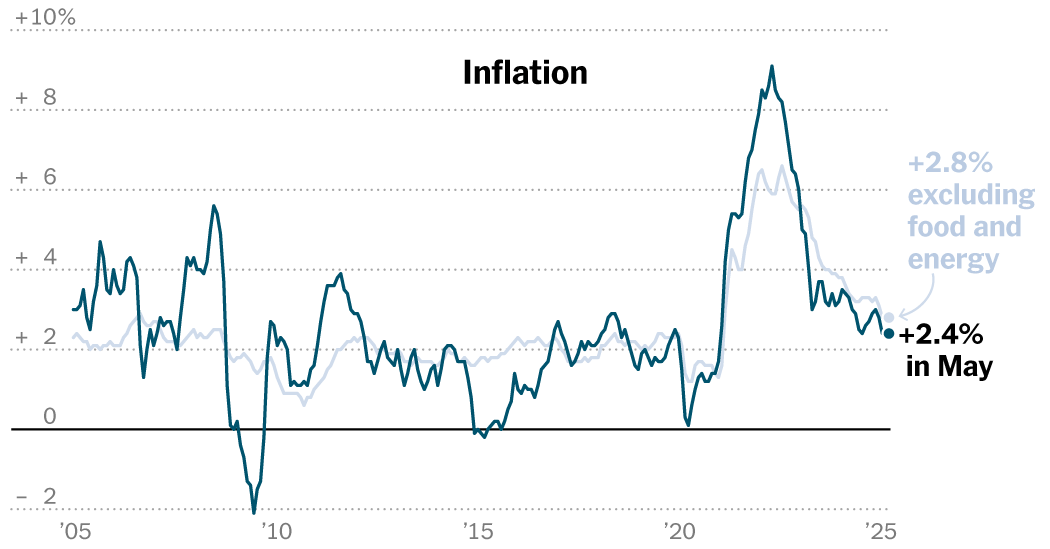

The patron costs index printed on Wednesday elevated by 2.4 p.c in Might from a yr earlier, a little bit earlier 2.3 percent in April Annual enhance.

The “principal” inflation was directed to 2.8 p.c. This measure, which undresses risky meals and vitality merchandise, is intently noticed by politicians as a gauge for primary value strain.

On a month-to-month foundation, the final measure elevated by 0.1 p.c, whereas the essential index elevated by 0.1 p.c. Each have been underneath the expectations of the economists.

The most recent knowledge printed by the Bureau of Labor Statistics mirror solely the early influence of G -N -Trump’s tariffs – the vary and scale of which they modify many instances after the president started his World Commerce Struggle. Tariffs are an import tax and economists count on the impact on costs to grow to be extra pronounced in the summertime, as extra companies are transferring increased prices to customers, as many have said that they are going to do.

Most of Business surveyed in May The New York Federal Reserve Financial institution mentioned that they had handed over no less than a few of their prospects’ charges. Almost half of the providers oriented firms have gone along with all these increased prices, elevating their costs, whereas one-third of the producers who responded to the survey did the identical.

Such a phenomenon takes place all through the nation. The final Beigewhich compiles financial anecdotes from the 12 regional banks within the Federal Reserve system famous that there are “widespread contact reviews that count on prices and costs to rise at a quicker fee”. Those that have been anticipating to go increased prices deliberate to make it “inside three months,” the report mentioned.

Tariffs have elevated the Central Financial institution’s prospects for inflation, development and labor market For this yr. Specializing in the second time period of G -N Trump within the White Home, inflation appeared on the street to return to the lengthy -standing objective of Fed 2 p.c after years of passing effectively above that stage after the pandemic.

Now the Fed is scuffling with how considerably G -n Trump’s insurance policies, which additionally embody immigration limitation, tax discount and discount of presidency spending, will enhance costs for Individuals and for the way lengthy every interval of upper inflation will proceed as the expansion is slowed down.

In minutes of the Fed’s final assembly in Might, the central financial institution workers collided with a prediction that wears Stagflation. They mentioned the recession was “virtually as possible” as his prognosis for muted development and better unemployment. The tariffs, they mentioned, have been anticipated to extend the “important this yr” inflation and proceed so as to add value strain in 2026 earlier than the inflation returned to the goal from 2 p.c to 2027.

Officers are probably the most frightened that tariffs can gentle a protracted value enhance, not a single leap. The chance is that Individuals will start to count on increased inflation in the long term to the extent that in the end turns into self-fulfilling. Such fixed inflation would forestall the Fed’s capability to help the economic system – by lowering rates of interest – if development is slowing down and the labor market weakens.

To date the labor market is cooling however there’s Not yet crackedS This strengthened the Fed’s opinion that it might take its time earlier than making nice choices on rates of interest. After lowering the mortgage prices by a share level final yr, the central financial institution maintains rates of interest from January, in a variety of 4.25 p.c to 4.5 p.c.

Fed officers are anticipated to increase this pause once they collect subsequent Tuesday and Wednesday and preserve the view that they will afford to be affected person with cuts. As the danger of inflation continues to be elevated, the central financial institution has made it clear that earlier than lowering rates of interest, it must see extra clear indicators that the labor market is deteriorating.