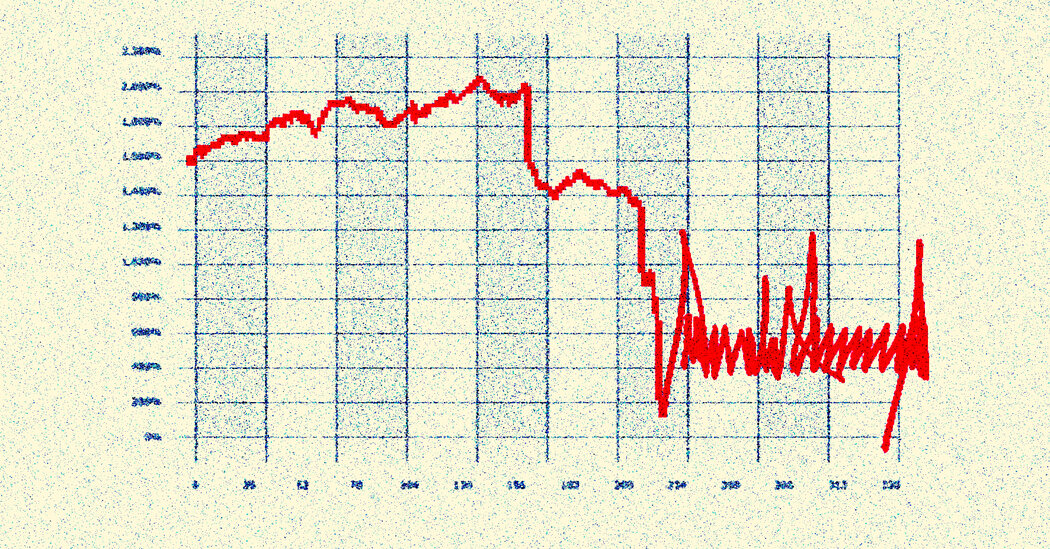

100 days by President Trump. Seventy days of commerce on WhipSaw in monetary markets. Thirty -three days misplaced. Greater than $ 6.5 trillion has deleted the worth of public corporations.

For the monetary markets, the drop to 9 % within the S&P 500 is on its strategy to the beginning of the presidential time period, as Gerald R. Ford took from Richard M. Nixon in August 1974 after the Watergate scandal. The decline is much more than when the know-how balloon bursts firstly of the century, and George W. Bush inherited a market that’s already in a free fall.

In distinction, G -H Trump inherited a strong basis financial system and the inventory change rising from one report excessive to a different.

This shortly modified when G -N Trump revealed his set of tariffs on April 2 -not the primary new import taxes introduced by his administration, however probably the most. Volatility erupted. Wall Road frantically started to battle the financial penalties of the brand new authorities’s insurance policies.

The S&P 500 collapsed by greater than 10 % in two days, declining with a number of the worst days of sale attributable to the pandemic in March 2020 and earlier than, the 2008 monetary disaster.

Since then, shares have been stabilizing, however the shock waves of the chaotic tariff concept proceed to ship tremor via the worldwide monetary system.

Some buyers have requested the function of the US on the coronary heart of this monetary system and the protection of the nation property throughout market turmoil, threatening the lengthy market order.

There are some optimists who notice that market misery appears to utter Mr Trump to surrender his most vital tariffs. However for a lot of buyers, he even hopes for business offers, tax discount and deregulation-returning to the extra private insurance policies on the agenda of the President-remain marred by pure uncertainty about what can occur afterwards.

“This can be a very unstable state of affairs,” says Michael Parsh, Chief Funding Officer at Tallbacken Capital.

Guarantees of prosperity ahead

It did not begin.

One month within the time period of G -N Trump, the S&P 500 scored a report excessive. Traders had been inspired by the seemingly limitless potential of synthetic intelligence and a brand new president who marketing campaign on a development agenda.

Turning to the Institute for Future Initiative Initiative in Miami on February 19, Trump assured buyers for financial prosperity ahead.

“There is no such thing as a higher place on Earth than the current and future United States of America underneath a sure president named Donald J. Trump,” he mentioned.

The buyers had been cheerful. “There was a lot optimism within the air,” mentioned Todd Ahlten, Chief Funding Officer of Parnassus Investments, including “There have been few warning indicators on the horizon.”

Nonetheless, inside a day of G -N Trump’s speech, issues about inflation started to weigh in the marketplace, rising in early March with the announcement of 25 % tariffs for Mexico and Canada. Economists expect tariffs, that are tax on imports paid by the importer, to result in greater costs for shoppers and companies.

Traders who as soon as believed that G -N Trump’s aggressive marketing campaign was speaking about business imbalances wouldn’t change into politics, out of the blue encounter a brand new actuality. The president was severe about imposing tariffs, and he was able to threat the sale of the inventory market to realize his objectives.

Traders haven’t but been ready for the subsequent.

“An enormous change in paradigm”

The announcement of double-digit tariffs for nations world wide prompted the worst two-day sale for the S&P 500 since March 2020. The distinction this time was that the slide got here on to authorities coverage.

“It was a fast sale, particularly once you suppose there was no exterior shock just like the pandemic,” says Mohammed El-Erian, President of Queens School at Cambridge College and former Pimco CEO, one of many world’s largest property on this planet.

Economists have begun to sound the alarm that the financial system that has been experiencing a relentless slowdown in workplaces when inflation is cooling is now specializing in a a lot narrower decline. The administration once more shrinks the slide of the shares. Traders rushed to guard their portfolios from extra losses.

“The American financial system has moved from celebrating financial exclusivity to fears that it’s embarking on stagflation or recession,” mentioned Dr. El-Erian. “This can be a enormous change within the paradigm for an important financial system on this planet.”

The week earlier than the tariffs are anticipated to return into power, each the NASDAQ technological index and the Russell 2000 index of smaller corporations, which are typically a barometer of the prospects for the financial system than a lot bigger, multinational companies-launched within the markets of bears.

The bear market, by which the index drops by 20 % of its peak, is uncommon. When an individual seems, it’s a marker of maximum investor pessimism. On this case, analysts and economists say, that is above the path of the financial system in response to tariffs. This can be a sale line on the market, changing into a protracted market.

When the markets closed on April 8 – the day earlier than the tariffs got here into power – the S&P 500 fell 18.9 % beneath its peak February. After the market continues to fall additional to a bear market, as the subsequent morning the tariffs got here into power, Mr Trump has introduced a 90-day pause for probably the most censor tariffs for all nations, except China. The shares have gathered, with the S&P 500 recorded its finest day since 2008.

Alarm bells within the monetary system

However it isn’t the inventory change that G -n Trump mentioned that he had made him blink.

The identical week, one thing unusual occurred on each the bond and the foreign money markets. Often, in occasions of disturbance, buyers world wide search US property as a supply of reliability and security. They purchase {dollars} and authorities debt, normally pushing everybody’s worth.

That is what occurred when the inventory change initially fell aside. However within the days resulting in the tariffs and the bonds of the US authorities, and the US started to fall as they departed from alarm bells via Wall Road.

The merchants described a way of panic and worry, as costs dropped extra, sending the yield.

The 30-year bond of the Ministry of Finance started the week with a yield of simply over 4.3 %. In a single night time commerce earlier than the entry into power of tariffs, profitability – which is indicative of the prices of loans for the US authorities – has elevated over 5 %. It was an enormous market transfer, which normally strikes with a hundredths of a proportion level daily.

“The bond market may be very sophisticated,” Trump famous

The merchants identified the technical thresholds that had been violated within the bond market by inserting plenty of gross sales from numerous pc -controlled buying and selling methods that robotically purchase and promote on the idea of predefined programming.

Then the sale has picked up velocity, with some analysts saying that the weird strikes are an indication that buyers are hitting the US property towards the background of chaos attributable to tariffs.

The American exclusivity is rooted in the concept that the US performs a central function on this planet’s monetary markets, the place the greenback is reserve foreign money and the nation’s debt is on the coronary heart of borrowing internationally and internationally. This many idea, analysts say, has change into susceptible.

Towards the backdrop of chaos, Trump has additionally elevated assaults on folks and establishments that underlie American exclusivity, resembling Jerome H. Powell, the chairman of the Federal Reserve, whose independence helps to based mostly on the arrogance of buyers within the US markets.

The president was sad that he had not lowered rates of interest, though the latter warned that this might result in extra inflation. Whereas many buyers additionally lengthy for much less rates of interest, it’s extra vital for them that the Fed maintains independence.

Extra Tariffs for Yo-Yo?

Since April 9, there was a change within the tone of the administration.

Officers have raised what they are saying have been optimistic commerce negotiations which can be behind the scenes.

Even when the dialog administration’s claims are rejected that within the case of China, buyers have signaled that the White Home is making an attempt to market one thing to cheer.

Nonetheless, few are able to guess on what occurs afterwards.

A bond banker mentioned his staff not made business selections with a time horizon of as much as six months, because it was final 12 months. As an alternative, uncertainty pressured him to make selections from every week to every week, relying on the doable stage of tariffs, which might not be recognized for weeks and even months.

Financial knowledge shall be carefully monitored for the indicators that tariffs lead. Revenue reviews will proceed to be organized for indicators that tariffs are hitting Fundamental Road.

Then it is going to be July and the tip of the 90-day pause, which put the charges and collapse in the marketplace in detention.

“If the administration quickly moderates tariff coverage and tariff uncertainty decreases, everlasting harm might be modest or insignificant,” says James Agelhof, an economist at BNP Paribas. He mentioned he was spending a better time frame asking purchasers about what a possible financial drop may seem like if the uncertainty of tariffs continues.

“If we proceed to a course by which tariffs behave like a yo-yo, we rise up, then down, then up once more, then this uncertainty is not going to lower and it will have a paralyzing impact on enterprise particularly,” he mentioned.

By mentioning this uncertainty once more on Wednesday, Trump has repelled the blame for the present turmoil in the marketplace on his predecessor.

“That is the Biden inventory change, not Trump,” writes Trump for Fact Social. “I didn’t take it till January 20. The tariffs will quickly begin to begin, and the businesses are beginning to transfer to the US in report numbers.”

“Be affected person!” He added.