Inflation has cooled unexpectedly in March, a welcome improvement given the uncertainty about President Trump’s world tariffs, that are anticipated to broadly result in worth strain whereas creating.

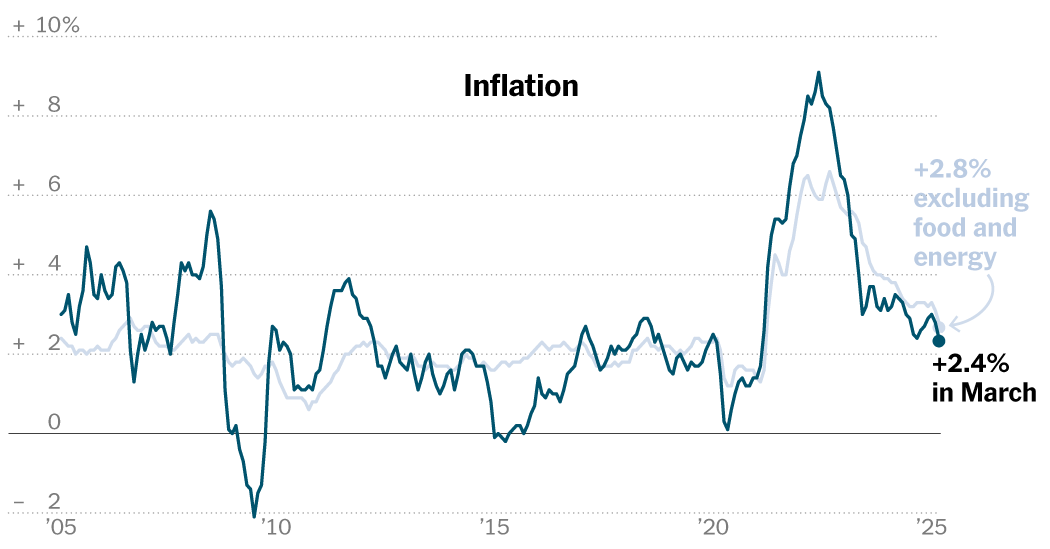

The buyer costs index elevated by 2.4 p.c final month in comparison with a 12 months earlier, a far shorter charge than a rise of two.8 p.c since February and the most important annual charge since September. Throughout the month the costs fell by 0.1 p.c.

The monitoring of the size on the coronary heart of inflation, which downplayed unstable meals and power objects, dropped to 2.8 p.c in March, after a rise of 0.1 p.c monthly. Normally, that is essentially the most gradual annual tempo for the “important” inflation of 2021.

The report, which was printed by the Bureau of Labor Statistics on Thursday and considerably subordinated the expectations of the economists, covers a interval earlier than the better a part of the Tariffs of G -N Trump have been launched. In latest days, the president’s plans have modified dramatically, ending with the administration on Wednesday, saying a 90-day break for penalties, which have been launched on April 2.

G -N Trump’s resolution to pause got here when the worldwide monetary markets have been breaking apart and started to Flash warning signs For the urge for food of traders for US property. The products coming to the nation from most different international locations will now face a ten p.c tariff, whereas the Chinese language import could have a 125 p.c charge after Beijing’s resolution to avenge US merchandise.

The principle a part of the Trump has considerably alleviated the issues concerning the diploma of financial injury arising from the commerce insurance policies of his administration. However economists warn that the tariffs that exist will nonetheless transform costly, which is able to lead not solely to extra gradual development, but additionally greater inflation.

Shoppers are vulnerable to bearing the burden of the price of tariffs, that are tax on imports. Companies are anticipated to attempt to undergo their greater prices to extend costs or to danger the margins of their income considerably.

In an interview with CNBC on Thursday, Andy Jassi, CEO of Amazon, mentioned he expects a lot of the third -country sellers on the enormous e -commerce platform to take action. “I perceive why, I wish to say, relying on which nation you’re in, you would not have a 50 p.c of the additional margin you possibly can play with,” he mentioned. “I believe they’ll attempt to cross the bills.”

Economists are nervous that customers will finally reject these costs and as an alternative will considerably restrict their prices. This could weigh additional development and even danger the economic system to give attention to a recession if companies are finally compelled to fireplace staff when demand falls.

The softer knowledge in March stem from a pointy decline in power costs, in addition to a decline in transport-related classes similar to airline tickets, automobile insurance coverage and used automobiles. Meals costs elevated by 0.5 p.c monthly, and for the 12 months they’re 2.4 p.c in comparison with the identical time final 12 months. An almost 6 p.c month-to-month enhance in egg costs was the most important contribution to this enhance.

The costs of the products dropped by 0.4 p.c in March, whereas the inflation of providers after power costs have been disadvantaged of solely 0.1 p.c.

The massive query concerning the Federal Reserve is the way to steadiness the dangers that inflation can enhance once more, as development slows down and finally what it means for rates of interest. Even earlier than the tariffs of G -N Trump, inflation was stubbornly sticky, with progress to the two p.c purpose of the central financial institution in latest months. This made a Fed extra amassing to proceed to scale back curiosity after a sequence of reductions final 12 months -caution that will increase with the appliance of upper tariffs.

With inflation, able to refine once more, even whether it is ultimately short-term, Fed made it clear that Bar for additional speed cuts is highS Because of this tangible proof will probably be wanted that the economic system is considerably weakening the Fed to take any motion.

Maybe the largest concern for the central financial institution is a scenario the place expectations for future inflation start to vary in a method that means that People are nervous concerning the worth strain that is still consistently. Jerome H. Powell, the President of the Fed, mentioned in a latest saying that the “obligation” of the establishment is to take care of inflation expectations and to “ensure that a one -off enhance in worth ranges doesn’t grow to be an ongoing drawback with inflation.”

Up to now, solely a handful of research based mostly measures have been displaced in a exceptional method, together with one managed by Michigan College. Market measures have fallen far much less. Nevertheless, Ricardo Reis, an economist on the London Faculty of Economics, mentioned the “measurement and visibility” of inflation shock is an issue, in addition to the “combined alerts” coming from the info from expectations.

“The Fed has a purpose for inflation to attain the impact on tariff inflation is sort of direct and possibly quick,” he mentioned. “He has to speak onerous.”