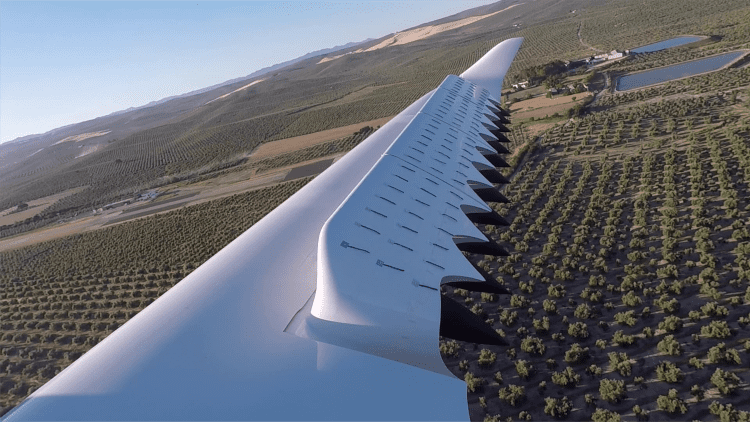

The German firm Lilium manufactures flying electrical passenger drones.

Lily

German aerospace startup Lily is going through chapter if it doesn’t elevate emergency funding from the federal government of the southeastern state of Bavaria.

An insolvency would mark a dramatic downturn for a start-up as soon as touted as Europe’s finest likelihood to create the twenty first century equal of “automobiles” that may fly.

Lilium is one in every of a collection of corporations attempting to construct “eVTOLs,” or electrical vertical takeoff and touchdown automobiles.

Popularly generally known as flying automobiles or air taxis, these automobiles are being developed by start-ups in the USA, Europe and Asia.

Right this moment, nonetheless, Lilium is in hassle. The corporate is desperately attempting to lift funds from German taxpayers. And up to now it has failed.

what occurred

Lilium is negotiating an emergency capital injection with each the German federal authorities and the state authorities of Bavaria.

The agency has requested 50 million euros ($54 million) in loans from the federal authorities. Nevertheless, his request was rejected by German MPs.

In a regulatory submitting revealed final week, Lilium mentioned it had “obtained a sign that the finances committee of the parliament of the Federal Republic of Germany is not going to approve a €50m assure for a deliberate €100m convertible mortgage”.

The proposed state help could be supplied by KfW, Germany’s state improvement financial institution.

Lilium “continues discussions with the Free State of Bavaria relating to a assure of no less than 50 million euros,” Lilium added in its submitting.

A spokesperson for Lilium informed CNBC that the corporate doesn’t plan to remark additional past the assertion outlined in its 6K submitting.

In response to Germany’s choice to disclaim state help to Lilium, Hubert Eiwanger, Bavaria’s financial system minister, criticized the movesaying it was “unlucky” that the federal authorities determined to not help the agency.

Daniel Wyszewicz, co-founder of the Berlin-based International Fund for Local weather Expertise Traders, mentioned that whereas it was “comprehensible” that lawmakers would withhold help for Lilium over considerations that the federal government was favoring one firm over one other, there was a misperception amongst politicians that air taxis are a “millionaire’s toy”. In response to him, this concept is “too short-sighted”.

Wiszewicz urged it was unfair that US electrical automotive maker Tesla – which burned by means of billions of {dollars} earlier than turning a revenue – was ever capable of get a mortgage from the US authorities, however Lilium was not.

What Lilium tried to construct

“Flying automobiles” may not be the correct time period. However what Lilium was finally attempting to deliver to the world was a vertical takeoff and touchdown airplane that would ferry individuals from one metropolis to a different to ease visitors congestion.

The corporate initially wished to launch its personal digital “name” service that will have customers order rides on its planes from designated areas the place the automobile is prone to take off and land.

Subsequently, Lilium determined to vary its enterprise mannequin.

As an alternative of growing the whole service itself, the corporate selected to associate with airways and airport operators that will construct the service product and infrastructure wanted to drive its ambitions.

Lilium jets can price as much as $9 million. The corporate was additionally growing a six-seater model that will price the customer about $7 million.

Lilium made massive offers with individuals like Lufthansa in Germany and Saudi Arabia. It has additionally agreed a tie-up with Groupe ADP, a world airport operator primarily based in Paris.

Rise and fall

Based by 4 college students in 2015, Lilium shortly earned a repute as one of many best-funded air taxi corporations in Europe.

The corporate managed to lift a whole bunch of hundreds of thousands of {dollars} from traders together with China’s Tencent, Atomico and Earlybird.

In September 2021, Lilium went public on the Nasdaq by means of a merger with a particular goal acquisition firm referred to as SPAC Qell.

At its peak, Lilium was value $3.3 billion. Its shares fell to lower than 50 cents, a greater than 95% drop since its inventory market debut.