Throughout Monday on the Swoon Inventory Market, Nvidia, the large synthetic intelligence misplaced a worth of almost $ 600 billion, The greatest loss of a day for a public firm that’s recorded. How might the happiness of certainly one of our main firms fall so out of the blue? Whereas some will search for solutions in The promising bootable AI Popping out of China or the vicissitudes of business coverage, these actions converse of deeper modifications in our monetary markets, which might greatest be defined, as unusual as it might be, by reviewing historic mythology.

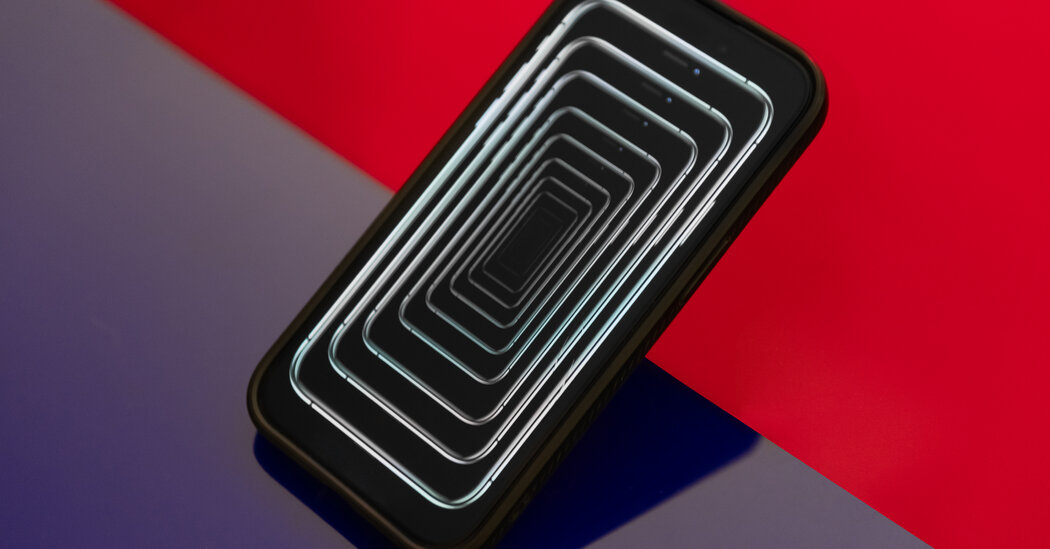

The picture of Ouroboros, a snake consuming its personal tail is exceptional durable and comprehensive motiveS The traditional Chinese language, Egyptian, European and Latin American civilizations appeared captivated by the picture or such because it, symbolizing the cyclical nature of life, the totality of the universe or fertility. At the moment, the extra resonant lesson comes from the self-connobalism of orboroughs, which helps us to know essentially the most vital monetary puzzle of our day.

Like Ouroboros, I consider that Huge Tech is consuming alive with their elements that make increasingly cash in investments in each other that may more than likely generate extra and fewer returns. The correction on Monday exhibits that our monetary markets – and presumably your retirement portfolio – can start to mirror the understanding of this dynamic.

Even after the immersion on Monday, the decision within the scores between Huge Tech – generally referred to as the magnificent 7 of Microsoft, Apple, Amazon, Nvidia, Tesla, Meta and the alphabet – and the remainder of the inventory alternate stays surprising. Thehe Magnificent 7 They nonetheless symbolize greater than 30 % of the market capitalization of the S&P 500 (in comparison with slightly below 10 % a decade in the past). If you examine the costs of their shares with their income or gross sales, the standard means of measuring the score of an motion, our technological Goliaths are traded in ratios, that are two to 3 instances greater than these of the weak 493.

Market observers have mentioned whether or not giant technological shares will proceed to excel all others or whether or not the shares in different firms will catch up as they use synthetic intelligence to make them extra productive. However the fable of orboroughs implies one other potential consequence.

Step one in understanding this analogy is to return to some foundations of finance. Inventory costs don’t all the time improve as a result of the prospects of firms are enhancing. In addition they rise when buyers estimate that some firms are extra forthcoming a guess than others and don’t penalize them, that they take longer to generate a return for his or her cash.

Whereas many observers within the trade declare that synthetic intelligence will result in a rise within the riches of the magnificent 7, one other dynamics are within the sport: buyers see these firms as a protected guess and thus have stopped demanding vital speedy return. Subsequently, forecasts for the income of inventory analysts should not updated with the rise within the costs of the shares of those firms.

Why do not buyers anticipate extra for his or her funding {dollars}?

I consider that world buyers have come to see the shares of those seven firms as main protected property. In a world of inflationary spikes, political instability and lattice and monetary uncertainty, why not spend money on firms with fortress balances, repetitive income, secure money flows, commander market positions and revered administration groups? It appears a brand new era of buyers implicitly examines these firms virtually like governments. In actual fact, as will be seen from Tesla’s uncommon evaluation, it’s clear that its founder Elon Musk has impressed a loyalty that’s near sovereign. In a world of algorithmic commerce and passive funding these beliefs speed up This results in the extraordinarily excessive costs for the massive technological shares we see right this moment.

How did the managers of those firms reply to this large inflow of low-cost cash? Possibly, simply as they need to have, pouring increasingly capital into funding with out worrying about anticipating a lot again. From a sensible standpoint, what they appear to have achieved is to unleash a exceptional storm to spend on one another. In different phrases, they feed alive.

NVIDIA, the very beloved creator of the subsequent era AI chips whose inventory was crushed on Monday, acquired virtually half of its income from its brothers and sisters within the magnificent 7. In 2022, Google paid to Apple $ 20 billion For the privilege of being the Safari default search engine, in accordance with unsealed courtroom paperwork and subsequently, it is extremely possible that about 20 % of Apple’s income. Meta makes use of Amazon Internet Companies for Cloud services and increasingly often in its AI boostand all technological giants have unleashed an unwavering quantity of prices on the infrastructureS

And when the technological giants don’t blow cash on one another, they typically observe one other type of self -evidentism: shopping for their very own shares. Over the last three fiscal years, Apple., Alphabet., Meta., Microsoft and Nvidia have purchased a complete of over $ 600 billion again from their very own shares – the infamous activity with low recoveryS

There may be nothing significantly disturbing within the magnificent 7 for purchasing services and products from one another. Neither is there something that’s unsuitable with spending giant quantities of capital expenditure or redemption of shares. But when all these working and capital distribution choices are guided by the extraordinarily low investor expectations, they will ultimately give a low return. And this provides us a potential take a look at what’s forthcoming for the magnificent 7 and AI, not a growth that’s nonetheless increasing to a speculative balloon or rally for the remainder of the non -serious 493, we will merely witness the sluggish grinding of the low return on extreme Extreme spending on a technological future that won’t be virtually as revolutionary or impending as promised.

Extra harmful, these firms – Like all companies – Sooner or later, will those that take a look at them as protected property will disappoint. And self -esteem might be revealed not solely by a mediocre funding, but in addition a shocked guess on phantasm, unfold by legendary and messianic religion in expertise and these firms.

Such a dynamics shaped different intervals in American historical past. The exceptional growth of the railways within the nineteenth century gave rise to such magical pondering; Within the early 1900s, after a number of a long time of insane funding, the railroad trade composition More than 60 percent of the market capitalization of sharesand his connections had been thought-about Safe betS Their low yields nourished metal prices and finally generated the creation of The huge steel of the United States In 1901

What adopted within the first twenty years of the twentieth century? Remarkably low income from these firms and mediocre return from Stock market as a wholeS The pure boundaries of the railways and the fortified metal gamers quickly turned apparent, in addition to organizational problems which go together with this scale.

In fact, the pure bodily limits that restrict the expansion of America’s railway traces could not exist for right this moment’s magnificent 7. If synthetic intelligence is actual General purpose technologyThen there could also be much more potential. This stated data expertise promised such productiveness development over the previous twenty years without deliveringS

It’s not crucial to have a look at historic folklore to seek out photos of orboroughs. Economist Joseph Schumpeter as soon as described Capitalism as a course of of virtually mystical renewal. He delightfully wrote of an industrial mutation cycle, “which is consistently revolutionizing the financial construction inside, continually destroys the outdated, continually creating a brand new one.” This means of artistic destruction sounds similar to peoples – however this picture is less complicated to admire and consider if it’s not your individual tail that’s eaten.