This text was revealed along with Propublica, a non -profit information that explores the abuse of energy.

The homes within the Altadena and Pacific neighborhoods nonetheless lit when the conversations turned to the value of fiery storms in Los Angeles and who would pay for it. Now it appears that evidently frequent harm and financial losses could also be greater than $ 250 billionS This, after a 12 months through which the hurricanes Milton and Helen and others Extreme meteorological events That they had already imposed tens of billions of {dollars} in US catastrophe losses.

With the entry into pressure of the complicated results of local weather -controlled disasters, we see the costs of insurance coverage costs within the nation to focus on the nation, elevating the price of possession of a house. In some instances, Insurance companies are downloaded of cities utterly. And in others, folks begin to transfer away.

Just a little mentioned result’s that rising costs of housing in the US could have reached the best threat in locations, leaving the nation of the hole of generations decline. That is the discovering of a New analysis From First Road, a analysis agency that research housing threats for housing and gives a few of the greatest out there local weather adaptation information, each free and commercially out there. The evaluation predicts an distinctive reversal of residential assets for People – practically $ 1.5 trillion {dollars} belongings over the subsequent 30 years.

The results are surprising: many People might face a change within the paradigm in the way in which they save and the way they decide their financial safety. Climatic adjustments increase the primary assumption that People can proceed to construct wealth and monetary safety by proudly owning their very own properties. In a way, it prevents the American dream.

Residence possession is the idea of America’s economic system. Residential actual property in the US price practically $ 50 trillion – they nearly double the scale of your entire gross home product. Virtually two -thirds of US adults are dwelling -owned, and the center home right here has evaluated over 58 p.c within the final 20 years, even after inflation reporting. Within the Pacific Palisades and Altada, this evolution erected many inhabitants within the higher center class. All through the nation, properties are the most important asset for many households – who personal roughly 67 p.c of their financial savings of their major residence.

It is a lot to lose: for folks and for the economic system of the nation.

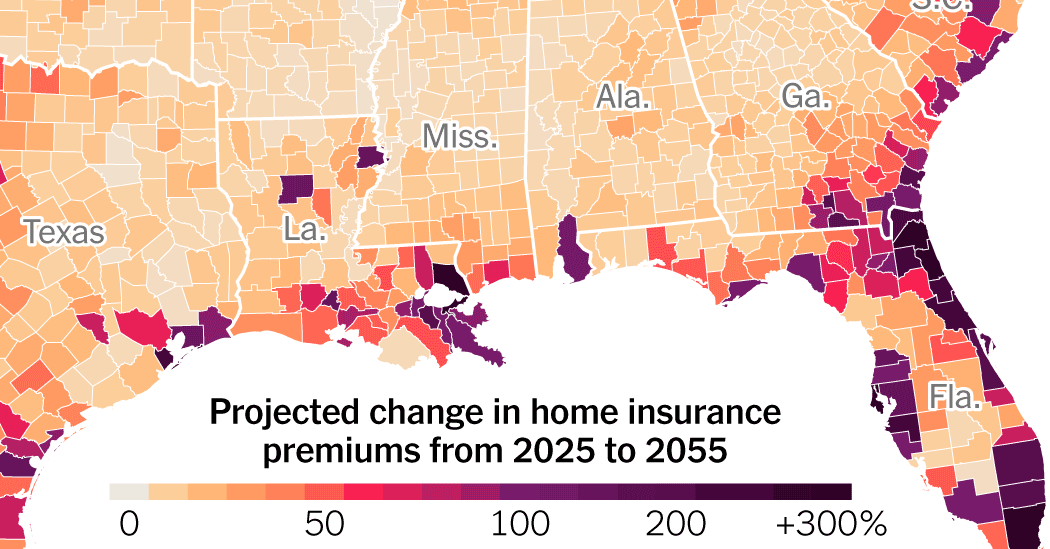

The primary avenue researchers discovered that local weather stress was the primary issue to stimulate insurance coverage prices. Common premiums have elevated by 31 p.c throughout the nation since 2019 and are steeper in high-risk climates. Over the subsequent 30 years, if insurance coverage costs are unobstructed, they may leap by a mean of one other 29 p.c, in keeping with First Road. Miami costs might be 4. In Sacramento, California, they might double.

And that is the place the systemic financial threat comes. Not way back, insurance coverage premiums have been a modest price of proudly owning a house, which quantities to about 8 p.c of the common mortgage fee. However at present, insurance coverage prices are about one fifth with the quantity of typical fee, the forward of inflation, and even the proportion of recognition of the properties themselves. This makes paper property, a nasty funding anyway. First avenue predicts that after three a long time – the time period of the basic American mortgage – the homes will price a mean of 6 p.c lower than at present. They design this decline within the overwhelming majority of the nation, confirming the fears that many economists and local weather analysts have lengthy held.

A part of the issue is that many individuals have been pressured to dwell within the many dangerous areas that decision a house exactly from having insurance coverage that was cheaper than it ought to have been. For years, as local weather -powered floods, hurricanes and fires have collected in addition to financial losses. Insurance coverage corporations canceled policiesHowever in response, he said that he indicated the help of housing homeowners, promising financial stability, even when this insurance coverage – required by most mortgage collectors – at some point disappeared. This maintained the price of manageable and suppressed nervousness, and the economies continued to buzz.

However these reductions “silence the alerts on the free market value”, in keeping with Matthew Khan, an economist on the College of South California, who research markets and local weather change. In addition they “slowed our adaptation”, making harmful locations like Florida’s coast and California’s fireplace hills look safer than they’re. First Road discovered that at present the insurance coverage threat of local weather on the costs of 39 million properties within the continental United States – which signifies that for 27 p.c of properties within the nation, the premiums are too low to cowl their local weather publicity.

No marvel the prices are rising. Insurers play catch up. However which means that People additionally play catching up with regard to the evaluation of the place they dwell. And this results in the potential of numerous folks to begin shifting. The truth is, First Road correlates the rise in insurance coverage charges and the discount of actual property values with widespread climatic migration, predicting that greater than 55 million People will migrate in response to local weather dangers inside the subsequent three a long time and that greater than 5 greater than 5 Million People will migrate this 12 months. First Road analysts declare that air -conditioning threat turns into as essential as faculties and views on the shore when folks purchase a house and that so long as property values are more likely to fall in most locations, they may rise – with greater than 10 p.c till the mid -century – within the extra favorable areas.

There are various causes to be cautious about these forecasts. Exactly Climate migration forecasts In the US, they’ve remained elusive to a big extent as a result of the modeling of human habits in all its varied motives is nearly unimaginable. First Road financial fashions additionally don’t seize the big justice that many People have collected in these properties, as during the last 20 years have failed within the final 20 years, capital that has given many individuals a pillow greater than comparatively modest predicted Lose. The fashions recommend that every one previous fashions of reckless development and zoning will proceed and they don’t bear in mind the scarcity of housing within the nation, nor the distinction between lengthy -time householders and a brand new era who’re making an attempt to purchase now.

As inaccurate as it might be, the work of First Road “performs the position of Paul Revere, for the problem we might face if we fail to adapt,” mentioned G -N Kahn. Local weather -controlled prices and local weather threat can result in intensive adjustments in each dwelling and migration possession, on the similar time, each elements are anticipated to proceed to extend.

Which means that housing homeowners must be way more weary or tenants must pay far more. Like many points of the Local weather Problem, this one will even direct the local weather and will likely be additional, particularly after comparatively secure areas seem and pretentious consumers flock to their actual property markets.

Nobody abandons Los Angeles. His wealth, density and state help make it way more resilient than locations like Paradise, California, the coast of New Jersey or Florida. However will probably be reworked economically and bodily. The Pacific Palisades are more likely to be restored to their previous splendor: the homeowners of his properties can afford it. Altadena, a middle-class neighborhood, can face totally different destiny: its properties usually tend to be faraway from buyers, genetrated and made inaccessible from each the price of restoration, insurance coverage, in addition to rising new properties as it’s reinstate.

On this method, Altadan would be the true harbinger of a future through which nobody however the wealthy personal their very own properties, the place insurance coverage is a luxurious commodity and the place tenants pay a month-to-month charge for giant personal capital homeowners who could also be extra applicable to handle this threat.

Abram Lustgarten is an environmental reporter of Propublica and the creator of “On the Transfer: The Earth’s overheating and the eradication of America.”

Graphics from Sarah Torosh

The Occasions is dedicated to publishing A variety of letters to the editor. We wish to hear what you consider it or in any of our articles. Right here AdviceS And here is our electronic mail: letters@nytimes.comS

Comply with the New York Occasions tab of the New York Occasions Facebook., Instagram., Tiktok., Whatsapp., X and TopicsS