President Trump has promised to create an period of US exclusivity with insurance policies that put america first and different nations.

However the strikes of G -N Trump within the first days of his administration have the other results of the US inventory market.

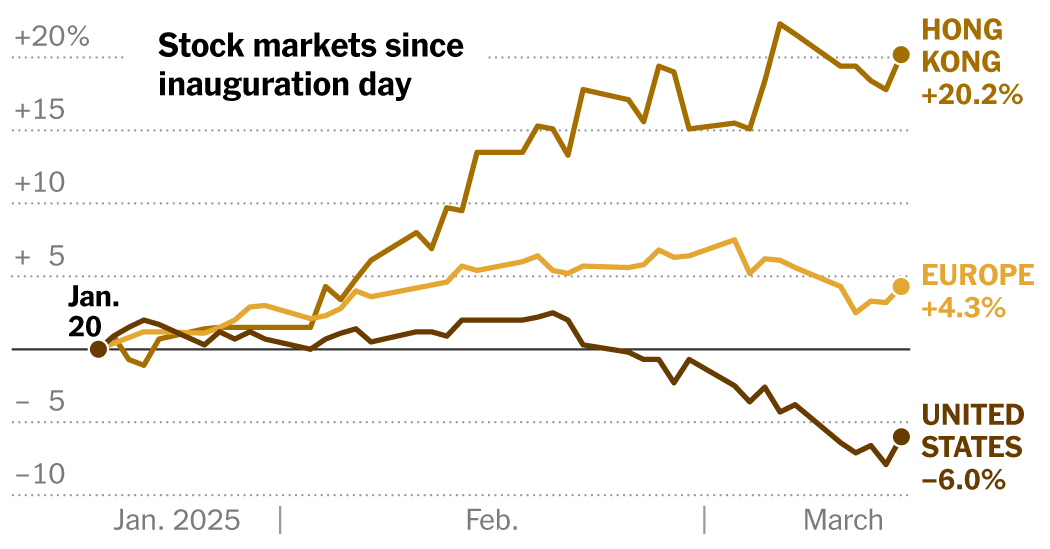

The S&P 500, which has been rising over the inventory indices of different nations for years, is now lagging behind main markets in Europe and China, as buyers have began withdrawing cash from america and redirecting them around the globe.

Following Mr Trump’s workplace, the S&P 500 fell by 6 %, whereas the DAX index in Germany has elevated by 10 % and the Stoxx 600 index in Europe has gained over 4 %. Different US indices have been doing even tougher because the European markets have been laid down by the continent’s navy spending plans after G -N -Trump made it clear that they needed these nations to do extra to guard themselves.

The Grasp Seng Index in Hong Kong has elevated additional, rising greater than 20 % since G -N Trump took workplace in January, led by the Chinese language authorities’s efforts to stimulate its economic system. Mexico’s IPC Index, which is concentrated within the nation and is proof against the steep tariffs of G -N Trump, is 5 % larger.

As US markets are shaken by uncertainty about G -N -Trump’s tariff insurance policies and deep cuts of the federal authorities, funding advisers have begun to direct clients to different inventory markets around the globe.

“It is undoubtedly a time to take a look at the previous US,” stated Jetan Kandhari, Deputy Chief Funding Officer of The Options and Multi-Esit Group at Morgan Stanley Funding Administration. She stated she has seen a step in conversations with purchasers who need to enhance their publicity to worldwide shares.

Even the worldwide markets which have fallen have been in a position to exceed the S&P 500. The FTSE All-World Index has dropped by 2.9 % after taking workplace, weighing on the shares listed by the US. The TSX index in Canada has dropped by 2 %. And the Japanese Nikkei 225 fell by 3.6 %.

In latest weeks, Wall Avenue has despatched numerous financial institution analysis notes, buyer displays and business concepts that advocate spinning away from america.

“Respect the soundness, fade the American exclusivity, and fear concerning the shocks of politics,” learn the title of a kind of displays by Bruce Casman, chief economist and international financial analysis at JP Morgan.

Brad Rutan, a market strategist at MFS Funding Administration, stated he additionally noticed alternatives exterior america. “It’s protected to say that there’s a lot of house for worldwide shares now.”

Within the final week, buyers have withdrawn cash from funds that we’re shopping for shares for the primary time this yr, in keeping with weekly information, which continues till Wednesday from EPFR World. The withdrawal quantities to a modest $ 2.5 billion, which is in comparison with roughly $ 100 billion in tributary within the first 9 weeks of 2025.

Whereas some merchants are extraordinarily quick to reply to new info available on the market, others, particularly those that count on to be invested for a very long time as pension funds or college donations, can take months to maneuver their cash.

“After such a protracted US superiority towards Europe, this stuff can’t be 180 levels a month,” says Greg Bull, head of the American Justice Technique and Deriva at BNP Paribas. “There are most likely many buyers who haven’t but been redirected.”

If buyers proceed to withdraw their cash from US shares and spend money on overseas markets, this will add to the stress of the sale that final week it extracted the S&P 500 in a correction set as a decline of greater than 10 % of its PIC.

The US markets are so massive {that a} full expulsion of overseas buyers is sort of unattainable, stated G -Ja Kandhari, “However the change can undoubtedly create market actions.”

The latest withdrawal got here after years when the US Trade was the envy of the world, attracting overseas buyers looking for the next return than they’ll safe their dwelling markets.

Roughly $ 420 trillion has gone into funds shopping for US shares in 2024, in keeping with EPFR World, serving to to extend the principle indices larger and contribute to the expansion of a handful of huge know-how corporations. Roughly two-thirds of the FTSE All-World Index evaluated the US shares, with 9 of the primary 10 shares within the measurement index coming from america.

Through the yr resulting in the presidential election, the S&P 500 outperforms many different indices around the globe, rising by 32 %. The following greatest was Germany DAX, which is 27 %.

Many buyers are nonetheless an extended -term scourge in US shares and imagine they are going to surpass overseas shares once more.

Europe can enhance authorities prices by doubtlessly stimulating progress. However this growth could be led by worry of conflict, not due to sustainable financial energy. And if america is coming into an financial decline, the remainder of the world is unlikely to be spared from the autumn.

“I feel, in the long run, all this uncertainty settles and we’ll nonetheless stay with america, which has benefits that Europe and different nations do not need,” says Paul Christopher, head of the worldwide market technique on the Wells Fargo Institute.

Different buyers marvel if the current second could be the start of a folding level, profiting from the lengthy -standing development of US exclusivity in monetary markets.

“I feel this dialogue is going on,” stated G -Ja Kandhari.