Buyers all over the world this week have despatched President Trump a transparent message about his new tariff coverage, it was triumphant to restore the financial order.

They do not prefer it.

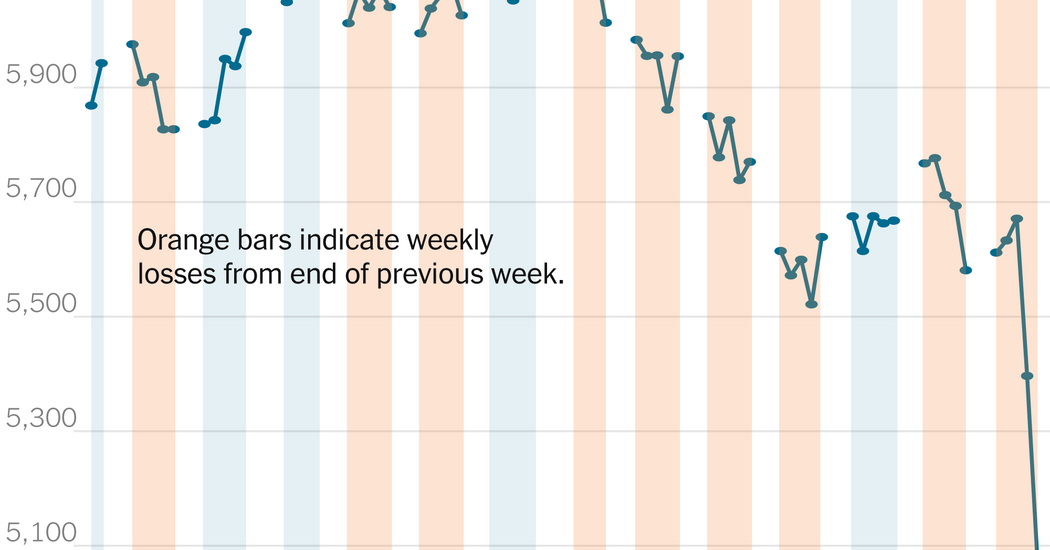

The S&P 500 fell by 6 p.c on Friday, bringing its losses for the week to 9.1 p.c. Shares had not fallen as far as rapidly for the reason that first days of the coronavirus pandemic – it was essentially the most regular weekly decline since March 2020.

As then, the S&P 500 rapidly approaches the territory of the bear market, a lower of 20 p.c of the best excessive and marks excessive pessimism amongst traders. By Friday, the index has dropped by over 17 p.c of its peak February. The technological heavy NASDAQ Composite and the Russell 2000 index of smaller firms which can be extra delicate to adjustments in financial views, and each have already been within the bears market. All around the world shares fell aside.

However this collapse was not led by the emergence of a brand new and lethal virus or an unexpected residential disaster, such because the one which deleted the values of the shares in 2007 and 2008, because it prompted the youngest financial disaster after the good melancholy.

He was led by a political resolution of the president.

“I hope that the message that the inventory change sends to the administration is heard,” says Ed Yardeni, a veteran market analyst in a tv interview. “The market provides massive thumbs to this tariff coverage.”

Market analysts and historians struggled to level out one other time when the president immediately prompted a lot injury to the monetary markets. There are some latest parallels: Unscrewing budget offer from Liz TrussThe British Prime Minister in 2022 led to the times of market chaos and she or he needed to resign inside weeks.

However the Trump isn’t fascinated by retreating. “My insurance policies won’t ever change,” he wrote in a social media publication on Friday.

On this approach, traders, economists and enterprise leaders rapidly admire the brand new and unprecedented insurance policies and financial injury that these insurance policies might trigger.

“We’re simply working via what it may well imply,” says Lindsay Rosner, the top of funding with fastened revenue a number of -income at Goldman Sachs Asset Administration. She added that the pure scale of the tariffs “will increase the probability of recession.”

It is a exceptional twist in moods. After Mr Trump was elected and within the first month of his administration, traders have been desirous to see what a pro-business administration that inherited a wholesome economic system could lead on. Additionally they anticipated that the president’s impulses for radical financial adjustments might be contained by the inventory market itself – a sudden decline might persuade him to vary the course.

Regardless of fears that the shares have been extremely valued, they continued to climb – reaching a peak in February.

However even earlier than the collapse this week, EPFR World knowledge has proven that traders have withdrawn $ 25 billion in funds they spend money on US shares within the two weeks till Wednesday when G -N -Trump introduced tariffs. Since then, J.

Buyers additionally dramatically elevated the probabilities of a significant discount in rates of interest this yr, predicting the federal reserve to intervene to assist the economic system. Wall Road gross sales deleted $ 5 trillion market worth from firms in S&P 500 in simply two days, in accordance with Howard Silverblat, Senior Analyzer of the S&P Jones Indics Index.

As unhealthy as it could be because the latest decline within the S&P 500, different market measures are in a worse form. Russell 2000 misplaced one quarter of its worth to its peak in November. Nasdaq Composite, which is loaded with technological shares that have been struck this week, decreased by practically 23 p.c of its December peak.

“It’s stated that that is actually unhealthy,” stated Liz Ann Sanders, a chief funding strategist in Charles Schwab. “This exceeds every part I noticed within the worst state of affairs of anybody. It did extra to the Dent Animal Spirits, which was one thing that revived the quick penalties of the election.”

Dan Iwasin, Chief Funding Officer of Pimco Giant Belongings, stated the tariff message this week is a “huge materials change within the international buying and selling system” and can result in “materials shock for the world economic system”.

“In latest a long time, the economic system has been an inclination to steer political choices,” he stated. “We might enter a interval the place politics is shifting the economic system. It is a very totally different atmosphere to spend money on.”

Some stated that G -n Trump recommended a precedent. In 2018, he imposed tariffs for international imports of metal and aluminum, photo voltaic panels, washing machines and $ 200 billion in ChinaS However these levies pale in comparison with what was carried out on Wednesday, and the impact on the markets was far higher.

Though G -H Trump has all the time promised to make use of the tariffs once more in an try and restructure the US economic system – returning manufacturing again to the nation and to make the USA much less depending on international commerce – the dimensions of coverage change caught traders, economists and enterprise leaders.

New taxes have elevated the typical efficient tariff price on US imports to a degree that has not been noticed for the reason that Thirties, S&P analysts stated.

Some traders hope that tariffs are simply a place to begin for negotiation that can take them down over time.

However though G -n Trump has recommended that he’s open to negotiating tariffs with different nations, China has already reacted by evaluating its further 34 p.c tariffs. Canada has rapidly launched its charges, and Europe can also be anticipated to reply.

“The principle line is so excessive in the mean time that even well-negotiated tariffs might be excessive,” says Adam Hats, a world chief of multi-assets at Janus Henderson Buyers. He feared the injury had already been inflicted.

“The injury has been prompted as a result of the tariffs have already got tooth and the habits of customers and the corporate is already beginning to change,” stated G -H Hats, as an echo, and can also be held by different traders – that the tariff discuss is already a cooled enterprise and shopper exercise.

Few chief leaders have talked concerning the tariffs, however those that have expressed anxiousness.

Because the tariffs have been introduced, Gary Friedman, CEO of the furnishings furnishings dealer, was on a name to revenue with traders. He was heard to swear after checking the value of Rh shares. RH receives lots of its merchandise from Asia, defined Mr. Friedman.

On Thursday, Sean Konoli, CEO of Conagra Manufacturers, advised analysts that the meals firm was making an attempt to maintain up with the sudden adjustments in tariff coverage.

“Issues are shifting not solely every week or every day, but in addition an hour now,” he stated.

Nonetheless, from the White Home, the message is among the abundance – if traders simply have the endurance to see it.

“Markets will develop” and “The nation will growth,” stated G -N Trump on Thursday. Howard Luni, the gross sales secretary, stated throughout an interview on Thursday that “US markets will do extraordinarily, extraordinarily effectively” In the long runS

Historical past reveals that even the tallest market disaster will finish after traders are happy that costs have fallen far sufficient to mirror the brand new actuality or one other change in coverage provides them cause to begin shopping for once more. On Friday, a March hiring report, which was far stronger than anticipated, displaying that the economic system was nonetheless on a strong assist final month, did not make the most of the market restoration.

Enterprise leaders have responded to analysis, saying they intend to decelerate plans for their very own investments. Airways leaders, banks, retailers, vitality firms and others monitor their firms’ estimates this week. Customers, after making an attempt to exit to the tariffs for some massive ticket objects, stated they supposed to spend much less.

“I am undecided what we have now, it provides the businesses a variety of confidence,” stated G -ja Sonders by Charles Schwab. “I believe it doesn’t alleviate this part of uncertainty.”