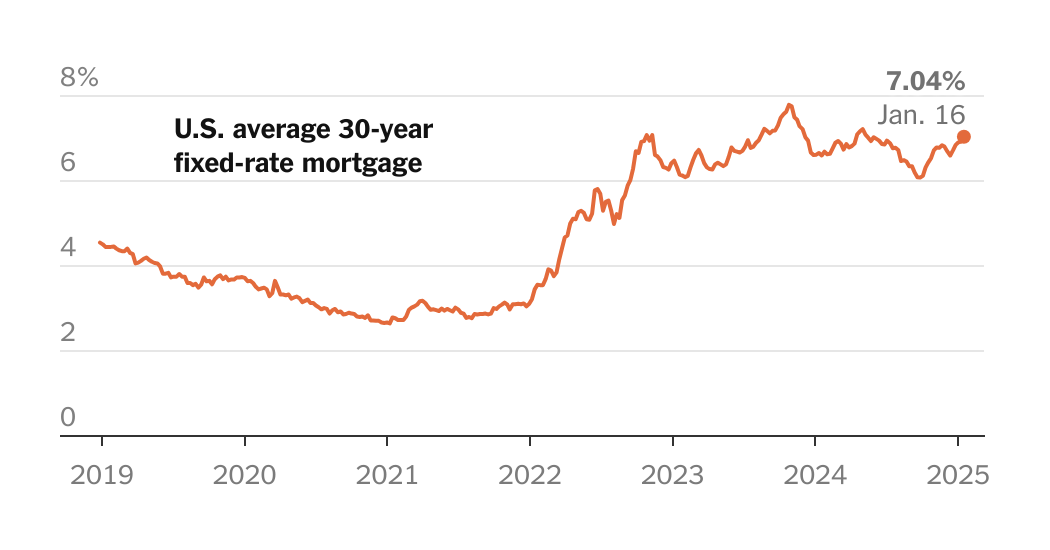

The common rate of interest on 30-year fixed-rate mortgages topped 7 p.c for the primary time since Could, Freddie Mac stated Thursday, extending a week-long rise that would push extra patrons and sellers away.

The interest on the 30-year mortgagethe most well-liked house mortgage in the USA, jumped to 7.04 p.c this week from 6.93 p.c the earlier week. Mortgage charges have a tendency to trace the yield of 10-year government bondswhich has risen in current months in response to a collection of sturdy financial information, persistent inflation and potential will increase in debt and deficits ensuing from the insurance policies of the incoming Trump administration.

“The underlying power of the economic system is contributing to this charge hike,” Sam Khatter, Freddie Mac’s chief economist, stated in a press release.

There was a second in late September when mortgage charges, after falling for months, appeared poised to fall beneath the symbolic 6 p.c threshold, a boon for would-be patrons. However that window is closed, no less than for now.

Inflation has just lately confirmed itself stubborn. In December, the patron value index a rose 2.9 p.c from a yr earlier, the Labor Division stated on Wednesday, indicating that the Federal Reserve has not but gained its battle towards quickly rising costs. Final yr, the Fed started chopping rates of interest from their highest ranges for the reason that 2008 international monetary disaster, chopping them 3 times. The central financial institution signaled only two cuts this year and a few forecasters consider policymakers could not lower charges in any respect in 2025.

Mortgage charges rise even because the Fed cuts its rate of interest goal. This divergence is basically as a result of longer-term rates of interest, together with these for mortgages and auto loans, are decided by the market and replicate traders’ expectations of future financial situations. Though the yield on the 10-year Treasury observe has fallen over the previous few days resulting from some encouraging indicators within the newest inflation report, it stays a lot increased than it was just some months in the past.

And mortgage charges are greater than double what they have been within the early phases of the coronavirus pandemic, when the typical 30-year charge hovered round 3 p.c for intervals since 2020. and 2021 The rise has made many potential sellers reluctant to place their properties available on the market, unwilling to half with lower rates on their present mortgages.

However owners could finally modify to present charges, stated Lu Liu, assistant professor of finance on the Wharton College on the College of Pennsylvania. “Perhaps within the subsequent yr or two, folks will get used to them and be able to promote,” she stated.