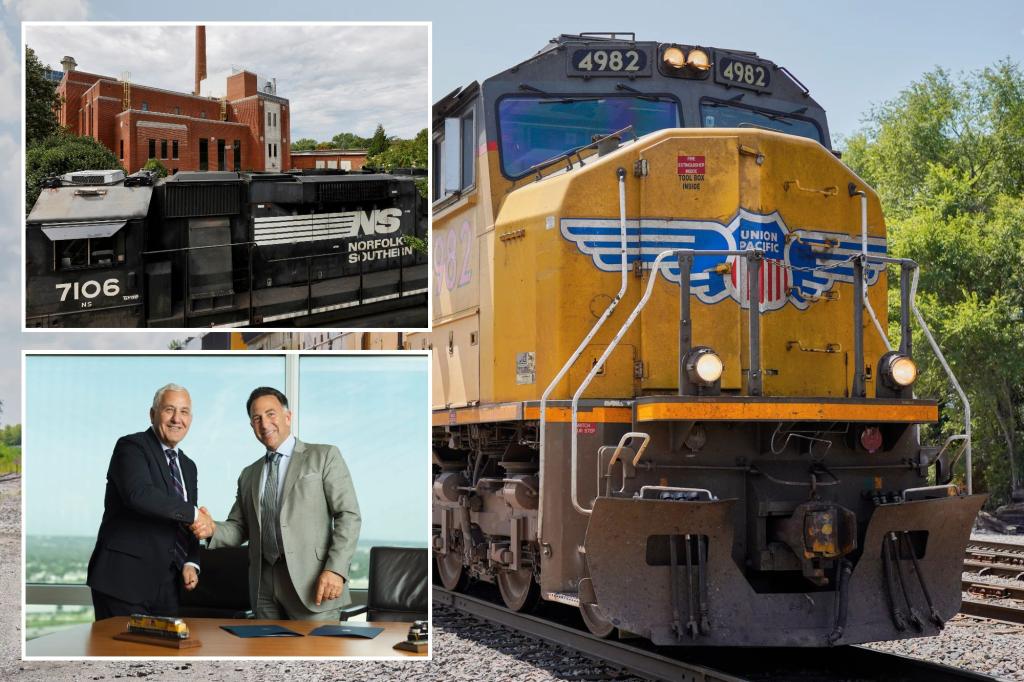

Union Pacific mentioned on Tuesday that he would purchase a smaller rival at Norfolk Southern in a $ 85 billion deal to create the primary cargo rail operator within the nation and reshape the motion of cereals in vehicles in the US.

If accepted, the deal would be the largest buy within the sector and mix the Union Pacific fortress within the western two-thirds of the US with 19,500 miles of Norfolk community, which predominantly covers 22 japanese states.

The 2 railway strains are anticipated to have a mixed worth of an enterprise of $ 250 billion and can unlock about $ 2.75 billion annual synergies, corporations mentioned.

$ 320 on the worth of the motion suggests a premium of 18.6% for Norfolk since its closure on July 17, when the merger studies appeared for the primary time.

The businesses mentioned on Thursday that they had been in superior discussions for doable merger.

The deal will face an extended regulatory management towards the background of Union considerations about potential curiosity will increase, service interruptions and job loss. The 1996 merger of Union Pacific and Southern Pacific has quickly led to extreme congestion and southwest delay.

The deal displays a change in Antitrust Application to President Trump AdministrationS The manager orders aimed toward eradicating the boundaries in entrance of the consolidation opened the mergers, which had been thought of unlikely.

Patrick Fuchs, the chairman of the Floor Transport Council, appointed in January, advocates for sooner preliminary examinations and a loud method to the situations of merger.

Even within the accelerated course of, the assessment can take 19 to 22 months, in line with an individual concerned in discussions.

The principle railway unions have lengthy been against consolidation, claiming that such mergers threaten jobs and danger disrupting the railway service.

“We are going to weigh the STB (regulator) and with the Trump administration in each method doable,” mentioned Jeremy Ferguson, president of the Good-Td Transportation Division, after the 2 corporations mentioned they had been in superior conversations final week.

“This merger just isn’t helpful for labor, the director/shopper or the general public as a complete,” he mentioned.

The businesses mentioned they had been anticipating to submit their utility to StB inside six months.

The Good-Td Transport Transport Division is the most important railway union in North America with over 1800 railway yards.

The North American rail trade is preventing the unstable volumes of cargo, growing prices of labor and gasoline and growing strain from freight forwarders as a result of reliability of service, components that may additional complicate the merger.

Union Pacific shares dropped by about 1.3%, whereas Norfolk fell by about 3%.

Consolidation

The proposed transaction additionally prompted opponents BNSF, owned by Berkshire Hathaway and CSX, to review merger choices, individuals aware of the query mentioned.

STB brokers are already doing preparatory work, anticipating that they’ll quickly obtain not just one however two MEGAMERGER solutions, an individual near discussions instructed, instructed Reuters on Thursday.

If each mergers are accepted, the variety of Class I railways in North America will shrink to 4 out of six, consolidating the primary routes of hundreds and improve the worth energy for the trade.

The final main deal within the trade was the merger of $ 31 billion into the Canadian Pacific and Kansas Metropolis South, which created the primary and solely single -row rail community connecting Canada, the US and Mexico.

This transaction, finalized in 2023, confronted extreme regulatory resistance to fears that it could restrict competitors, scale back jobs and violate the service, however was in the end accepted.

Union Pacific is estimated at practically $ 136 billion, whereas Norfolk Southern has a market capitalization of about $ 65 billion, in line with LSEG knowledge.