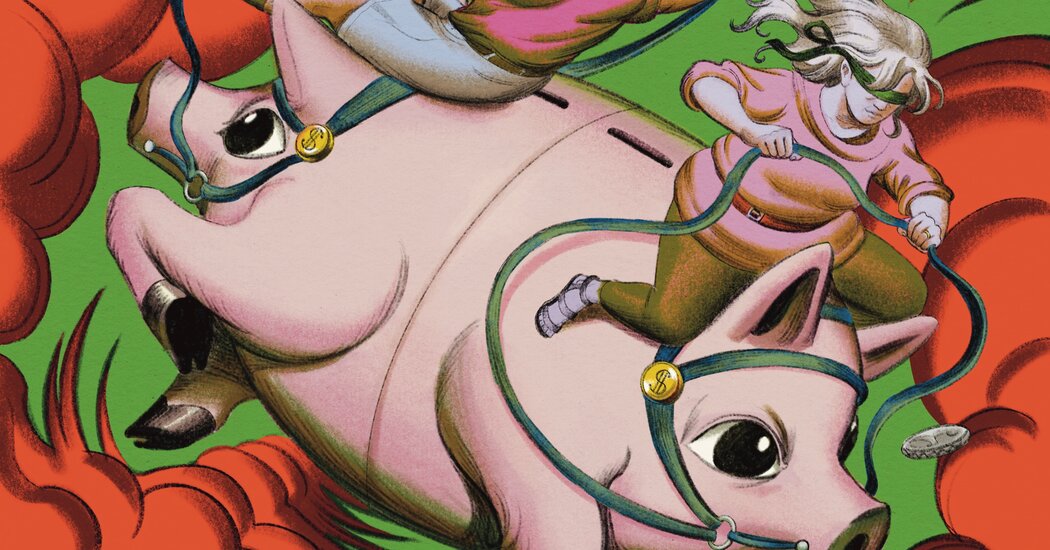

Here’s a pop take a look at for married {couples}.

Have you learnt your husband / spouse’s wage? How in regards to the steadiness of 401 (okay) of your accomplice – and the bank card? Bonus factors, when you can quote how a lot your husband or spouse thinks you need to stay comfortably in a pension and even at what age she or he hopes that this may occur.

If you’re like most married folks, you might be certain you’ll ace this take a look at. Virtually 9 out of 10 {couples} say they convey nicely with their cash accomplice, and 94 p.c say they’re open and clear with their higher half about finance, in response to surveys printed final 12 months by monetary service firms Faithfulness and AmericaS

The truth is? Not a lot.

A loyalty examine discovered that multiple -third of {couples} couldn’t correctly establish their accomplice’s wage inside not less than $ 25,000 of their precise pay. Greater than half didn’t agree a lot about quite a bit to avoid wasting for retirement. Analysis reveals related interruptions amongst many {couples} on the subject of debt., netGoals for financial savings and life.

This doesn’t even depend the candid secrets and techniques, which about 4 out of 10 married {couples} admit to maintaining cash, in response to 2025. Bank surveyS Main within the indiscriminate checklist: spending greater than their accomplice could be effective, adopted by hiding debt, bank cards or financial savings accounts.

“About 50 p.c of {couples} I discuss to have no idea their mixed family revenue and 90 p.c of these with debt have no idea how a lot they owe,” says Ramit Seti, writer of the ebook “Money for couples” and host a podcast by the identical title. “However past information and numbers, a very powerful factor that {couples} have no idea about their accomplice is what their imaginative and prescient is from a wealthy life – what ideally hope their cash will permit them to make and obtain collectively.”

Ignorance is just not bliss

This lack of expertise of key elements of partner’s funds could stop retirement planning and different objectives, reminiscent of shopping for a house or paying youngsters’s schooling at school, advisers mentioned. In spite of everything, it is onerous to get to your vacation spot if you do not know which path you actually are.

“When there’s misinformation or lack of readability on the sources it’s worthwhile to work with, it’s extra probably that you simply make non -optimal monetary choices, and companions’ habits and conduct usually are not all the time aligned with objectives,” says Douglas Bonepart, a monetary plan in New York, who writes his publication together with his spouse, which is “The joint account.”

The connection might also endure. “It is not on the identical cash web page can result in anxiousness, guilt and resentment,” mentioned G -n Boneparth.

Research assist the possibly opposed impact on household happiness. Research present, for instance, that {couples} who don’t talk nicely for cash or fail to make monetary choices collectively are likely to really feel extra glad with their relationship than those that do. A 2021 exploration In line with the Nationwide Monetary Training Fund, it discovered that among the many individuals who saved a secret about their accomplice’s cash, the fraud led to 42 p.c arguments and fewer confidence within the relationship for a couple of third.

Being poorly knowledgeable of the way in which the accomplice has managed household cash could be particularly problematic if a pair is split or the partner die-problem, which frequently hits harder for ladies who’re extra probably than males to go away funding and retirement planning of their male accomplice. A UBS study Girls discover that after the loss of life of a partner or the top of their marriage, three-quarters of widows and divorce face “unfavourable monetary surprises” as a hidden debt or much less financial savings than anticipated.

“Whenever you already grieve emotionally, it may be extraordinarily scary to search out your self additionally it’s a must to fear about how you’ll pay the mortgage or whether or not you’ll ever have the ability to retire as a result of you haven’t had the correct image of how your accomplice has processed cash,” mentioned Aja Evans, a monetary therapist in New York and the writer of the ebook “Feeling good finances.” “It simply makes a tough state of affairs a lot.”

Fact and penalties

If the shortage of communication and transparency for cash hurts a lot, why so many spouses behave one another within the monetary darkish?

One widespread perpetrator is the couple’s system for family finance administration. Virtually half of the pairs in Exploration of the beliefFor instance, they mentioned they didn’t make monetary choices collectively. Different research present that in lots of relationships, one accomplice takes on the function of Chief Monetary Officer by taking over the main function of funding choices and monetary planning that the opposite partner can miss of the cycle.

“Fairly often the query is that this method to dividing and conquering cash, not {that a} accomplice intentionally hides belongings or revenue,” says Ryan Tuctor, Vice President and Monetary Marketing consultant on the Constancy Investor Middle in Framinggham, Massachusetts. “One partner could be very all in favour of funding and tracks the progress of spreadsheets, and the opposite feels hanging out of numbers and particulars and is glad that they go away to go away the accomplice.” One partner could be very all in favour of funding and tracks the progress of spreadsheets, and the opposite feels exceeded by the numbers and particulars and is comfortable to go away it to the accomplice. “One partner could be very all in favour of funding and tracks the progress of spreadsheets, and the opposite feels exceeded by the numbers and particulars and is comfortable to go away it to the accomplice.

A exploration Within the journal of the Client Analysis Affiliation, it confirms {that a} accomplice who’s extra assured in finance is inclined to handle decisions-whether or not this individual actually is aware of extra about cash or not. “Notion and actuality usually are not utterly aligned,” says Scott Rick, Assistant Professor of Advertising on the Michigan Enterprise College and the examine co -author. “Companions are literally a lot nearer in monetary information than they assume.”

It additionally contributes to the shortage of communication and transparency: a want to protect peace. Greater than six in 10 individuals who admitted that they had been mendacity to a cash accomplice, mentioned worry of disapproving was a motivating issue, in response to the Nationwide Monetary Training Fund explorationS

“They might not wish to have the dialog as a result of they’re ashamed or embarrassing or assume their husband will decide,” says Margorita Cheng, a monetary planning in Gainersburg, D.M.

Offering battle typically has a lot in widespread with the earlier experiences of every accomplice – say, if their very own dad and mom argue quite a bit in regards to the household’s funds or a former accomplice, continuously criticized their spending habits – as in at the moment.

“So usually, once we discuss to our accomplice about cash, we discuss to the ghosts of their previous relationships,” mentioned Stii. “We enter with one set of assumptions, our accomplice enters with one other and one plus one is the same as a thousand.”

What to do: grow to be a group

Advisers suggest that {couples} meet usually to speak about their funds – what many name a date for cash. However giving it a candy title and including meals and wine in itself is not going to result in extra open communication.

“” Hey, honey, let’s exit to dinner and let me take this spreadsheet for the appetizer “will not take you the place it’s worthwhile to go,” mentioned Mr. Bonepart.

This is what I am going to.

Begin with objectives, not numbers. Advisers recommend that you simply maintain month-to-month or quarterly calendar conferences to speak about your funds, the primary sitting specializing in the aspirations, not the present particulars, as a lot as you save and spend.

“The aim of this primary assembly is to maneuver away, feeling good about speaking about cash,” mentioned Stii.

Prompts may also help you’ve got a dialog about shared objectives and what’s fearful about your accomplice. Dn bookFor instance, it consists of exercise sheets that assist {couples} set a wealthy life and make 10-year buckets. D -Jun has spouses who report their greatest monetary priorities individually, after which the change lists. D -n Boneparth is a fan of {couples}’ cash in app PairedS

The approaching of the temper assembly that it is possible for you to to know this factor collectively is vital, in response to Research Posted final 12 months within the Journal of Client Psychology. The authors be aware that “taking a look at conflicts as permissible, not everlasting,” mitigates anxiousness and will increase the probability of companions speaking brazenly about their funds.

Arrange for fulfillment. When you go to sharing information and numbers, begin with the fundamentals. “At a minimal, each companions have to know what monetary accounts they’ve, how a lot they’re in them and how one can have entry to them,” mentioned G -Ja Victor. “In addition they want an understanding of a excessive degree of their monetary picture-whether they’re on their approach with financial savings and prices.”

Using joint accounts to pay every day prices and save non-retirement objectives reminiscent of constructing an emergency fund makes sharing these particulars simpler, consultants say. It additionally forces companions to be extra clear about their prices.

“There are much less alternatives to hide anxious purchases or habits to spend when {couples} use a joint account,” says Dr. Rick, who studied The Impact of the structure of bank accounts For romantic relationships. “Joint accounts additionally assist companions assume as a group.”

Cash administration purposes are one other software that {couples} can use to share details about their prices, saving and investing. Amongst these advisers, they suggest: Honeyduewhich is a free app specifically designed for {couples}; Monarch’s money ($ 14.99 per 30 days; $ 99.99 if paid yearly); and Hoof ($ 13 a month; $ 95 if paid yearly; not accessible for Android gadgets).

Nevertheless, sharing particulars about every transaction is probably not vital – and even excellent. Dr. Rick additionally advisable that each partner maintains a small checking account with out private use questions that may eradicate the worry of judgment that causes many spouses to cover prices or saving from their accomplice.

“We do not want full transparency as a lot as we’d like translucent,” he mentioned. “Everyone seems to be entitled to just a little confidentiality.”

Present your husband some grace. To assist discourage stress, when viewing your funds collectively, keep away from guilt.

“Do not are available with” You probably did this “or react with” you spend what? “As a result of he’ll simply shut the dialog,” mentioned Gia Evans. “Speak as an alternative, which bothers you or excites how cash impacts you and why, so your accomplice understands the place you might be coming from.”

This want to see your accomplice’s perspective and share your individual is essential. “{Couples} usually go right into a dialog in regards to the cash centered on being proper,” mentioned G -Ja Cheng. “The essential factor is to get there that they do the correct factor – collectively.”