The Federal Reserve is anticipated to take care of its primary proportion of steady on Wednesday after a collection of cuts that lowered the share proportion final yr.

Which means that shoppers who wish to borrow will most likely have to attend a bit extra for higher offers for a lot of loans, however the financial savings will profit from extra steady yields on financial savings accounts.

Central Financial institution is ready for extra readability on the financial prospects and influence of the President Trump’s policies to TariffsImmigration and widespread federal cuts. The Trump publicly attacked Fed President Jerome H. Powell and his colleagues to take care of the price of borrowing too excessive.

The speed of FED fee is set in a spread of 4.25 to 4.5 p.c. In an effort to scale back inflation, the central financial institution started to rapidly elevate the charges – from almost zero to greater than 5 p.c – between March 2022 and July 2023. Costs have been considerably cooled and the Fed has turned to scale back the chances in September, November and December.

To Mr Trump Inflation polishes can encourage the Fed to decelerate extra proportion. However on the identical time the lengthy -term rates of interest decided by the markets Volatileinfluencing a variety of client and enterprise loans prices.

Automated charges

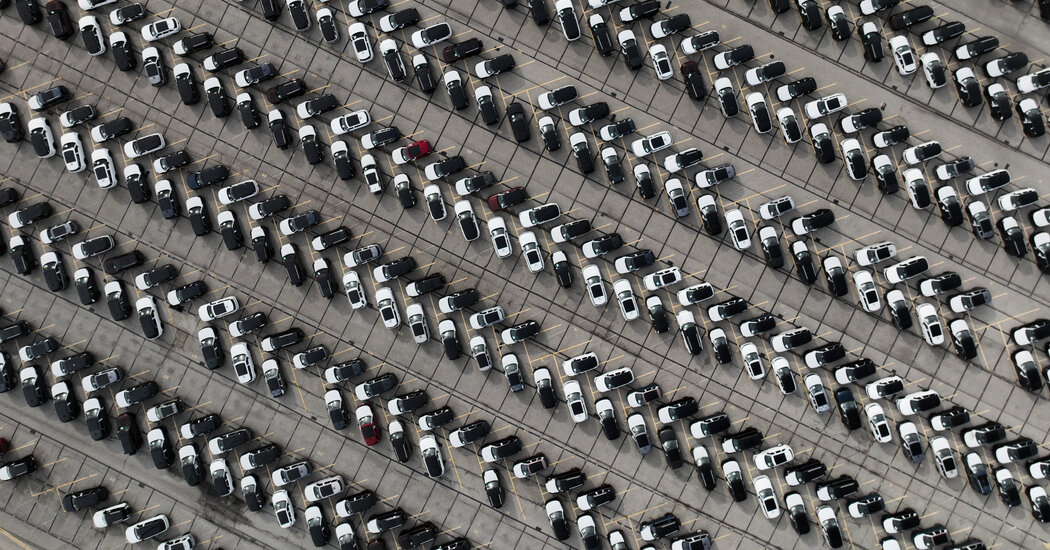

What is going on now: Automated charges are usually larger and automobiles costs stay elevated, Making an accessibility challengeS And that is earlier than us the tariffs to threaten Press the prices even moreS

Automobile loans have a tendency to trace the yield of the 5 -year word of finance, which is influenced by the Fed’s key fee. However different components decide what number of debtors truly pay, together with your credit score historical past, sort of car, mortgage interval and advance cost. Collectors additionally consider debtors ranges to turn into Delinkment for car loansS Like these move higher., So do the charges, which makes the mortgage {qualifications} harder, particularly for these with decrease credit score outcomes.

The common fee of latest automobile loans was 7.2 p.c in March, According to EdmundsAutomobile procuring web site, unchanged from February and March 2024. Used automobile costs are larger: the common mortgage brings 11.5 p.c in March, in comparison with 11.3 p.c in February and 11.9 p.c in March 2024.

The place and how you can store: After getting established your finances, get a automobile mortgage prematurely by a Credit score Union or Financial institution (Capital One and Ally are two of the biggest automobile collectors), so you could have a place to begin to check the supplier’s funding for those who resolve to go on this route. At all times negotiate the value of the automobile (together with all charges), not the month-to-month funds that may darken the mortgage phrases and what you’ll pay in frequent throughout the mortgage life.

Bank cards

What is going on now: The rates of interest you pay for all of the balances you put on had been barely decrease after the Fed’s lowest cuts, however the reductions had been delayed, consultants stated. Final week the common rate of interest on bank cards is 20.09 p.c, in line with BangaraS

Nevertheless, it relies on your credit standing and the kind of card. Prize playing cards, for instance, typically cost larger than common rates of interest.

The place and how you can store: Final yr the Shopper Monetary Safety Bureau send a flame To tell people who the 25 largest bank card points had charges that had been eight to 10 proportion factors larger than smaller banks or credit score unions. For the common card holder, which may add as much as $ 400 to $ 500 extra curiosity a yr.

Think about searching for a smaller financial institution or credit score union that may give you a greater deal. Many credit score unions require you to work or stay extra particular in an effort to qualify for membership, however some greater credit score unions could have Rules more freeS

Earlier than you progress, name your present card writer and ask them to match the most effective rate of interest you could have discovered in the marketplace you could have already certified for. And for those who do Transfer your balanceMonitor the charges rigorously and what your rate of interest will go to after the interval entered.

Mortgage

What is going on now: Mortgage charges have been variableS Costs reached about 7.8 p.c on the finish of final yr and fell solely 6.08 p.c on the finish of September. Stable financial information and considerations in regards to the doubtlessly inflation agenda of G -N Trump has once more pushed the charges a bit larger, though they’ve been ready in current weeks.

The costs of a set fee of 30-year-old mortgages don’t transfer in tandem with the Fed indicator, however as a substitute often monitor the yield of 10-year treasure bonds, that are influenced by numerous components, together with expectations for inflation, the Fed’s actions and the way buyers react.

The common proportion of a 30-year-old fastened mortgage is 6.76 p.c as of Could 1, which is lower than 6.81 p.c within the earlier week and seven.22 p.c a yr in the past.

Different residence loans are extra associated to the selections of the Central Financial institution. Residence mortgage strains and mortgage with an adjustable rate – which carry variable rates of interest – are often adjusted inside two cycles of invoicing after a change within the rates of interest of the Fed.

The place and how you can store: Future residence consumers can be sensible to obtain a number of mortgage Tariff quotes on the identical day as tariffs hesitate – from the choice of mortgage brokers, banks and credit score unions.

This should embrace: the speed you’ll pay; every Discount pointsthat are non-obligatory charges that consumers will pay to “purchase” their curiosity; and different gadgets reminiscent of a charges associated to the creditor. Take a look at ”percentage“, Which often consists of these things to get comparability of apples to apples at your general prices for various loans. Simply keep in mind to ask what’s included in Apr

Financial savings accounts and CDs

What is going on now: The entire on-line savings Deposit Accounts and Certificates money market funds have a tendency to maneuver in accordance with Fed’s coverage.

Savers not make the most of probably the most sugary yields, however you’ll be able to nonetheless discover a return in on-line banks of 4 p.c or extra. “The Fed, eradicating his accelers with a discount in rates of interest, implies that these yields are prone to stay tall for some time, however this is not going to proceed ceaselessly,” says Matt Schultz, Chief Analyzer of Lendingtree Customers, the web mortgage market.

In the meantime, the yield of conventional industrial banks stays anemic throughout this era of upper percentages. The common proportion of the nation’s financial savings accounts is just lately 0.61 p.c, in line with BangaraS

The place and how you can store: Costs are one consideration, however additionally, you will wish to see SuppliersMinimal deposit necessities and all charges (excessive -hand financial savings accounts often don’t cost charges, however different merchandise, reminiscent of money market funds, do). Depositaccounts.com, a part of LendingTree, tracks charges in hundreds of establishments and is an efficient place to begin evaluating suppliers.

Try our colleague Jeff Somer columns for More insight in cash market funds. The yield of Crane index 100 cash fundsthat traces the biggest CashIt was 4.14 p.c by Tuesday, which is lower than 5.15 p.c in February 2024.

Pupil loans

What is going on now: There are two fundamental varieties of pupil loans. Most individuals first flip to federal loans. Their rates of interest are fastened to the lifetime of the mortgage, they’re much simpler to get youngsters and their compensation circumstances are more durable.

Current rates are 6.53 p.c for college students, 8.08 p.c for unpublished graduates for graduates and 9.08 p.c for the plus loans that each dad and mom and graduates use. Costs are reset on July 1 every year and observe a method primarily based on a 10-year bond tender in Could.

Non-public pupil loans are a bit bigger card. College students typically want a joint signature, costs will be fastened or variable and rather a lot relies on your credit standing.

The place and how you can store: Many banks and credit score unions need nothing to do with pupil loans, so you’ll want to store huge, together with the collectors who specialise in non-public pupil loans.

You’ll typically see on-line advertisements and web sites providing rates of interest from every creditor that may range with 15 proportion factors or so. Because of this, you have to to surrender loads of info earlier than you obtain a sound worth provide.