When Brian P. Brooks was a monetary regulator throughout Trump’s first administration, he’ll hear complaints about “deboning” and can be compelled to not roll his eyes.

The expression is utilized by representatives of some fairly polarizing enterprises, similar to personal prisons and fracking operators who complain to G -N Brooks, The currency controllerthat their financial institution accounts are closed with out warning. His response was decreased to the equal of the free marketplace for troublesome luck. He didn’t see him as his job to power banks to do enterprise with anybody extra particular.

5 years later, Brooks, who now runs an middleman firm and advises cryptocurrency corporations, says he’s satisfied there’s a downside. It’s amongst an growing variety of folks on the earth of finance who has known as on the Trump administration staff within the final half yr of conferences in Washington and on the Mar-Lago Membership in Florida-to break into observe.

“The electrical energy firm can’t refuse to serve as a result of it doesn’t like your look in addition to the financial institution,” says G -N Brooks in an interview.

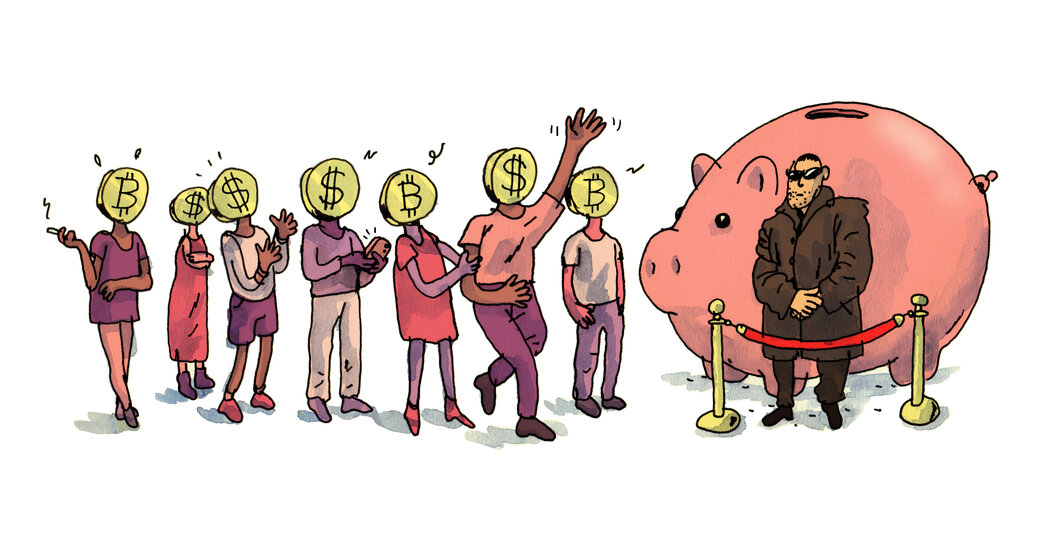

In latest months, Debaning’s cry has escaped conservative and non secular teams and Trump’s group accountable collectors in politically motivated discriminationS Comes from cryptocurrency companies that say provisions to free them from the opening of abnormal financial institution accounts and from the liberal legislators who discuss individuals and companies whose ATM playing cards are excluded with out warning.

President Trump and Minister of Finance Scott Bensten raised the query, in addition to Senator Elizabeth Warren, a Democrat from Massachusetts. And dozens of state attorneys have written to the heads of main banks requiring solutions.

But when there’s a political consensus that debuting is an issue, there may be much less settlement on what to do on the matter. Or on what it’s in any respect.

The time period is most frequently elevated by those that declare that the monetary system has locked them due to their political positions. These refusals could embody closing accounts or refusing to supply financing or signing loans for sure kinds of actions.

Nonetheless, there isn’t a authorized proper to a checking account. Banks are forbidden to discriminate towards the reception primarily based on protected elements, together with race and gender, however are usually allowed to keep away from classes of shoppers they think about too dangerous, similar to grownup leisure or depending on money.

What seems as prejudices for some is for others, simply the financial institution makes use of its judgment to handle a successful enterprise and keep away from depositors who elevate pink flags. Legislators say there have been thousands of debating complaints in the previous couple of years,

“The hysteria of debate is all of the smoke, there isn’t a fireplace,” says Adam J. Levitin, professor of legislation and finance on the College of Georgetown. “This can be a lot of self -service and unverified statements from dangerous companies and shoppers.”

However even collectors and regulators who haven’t handled these complaints as a precedence now say publicly that they’re significantly learning it.

The Trump Administration advised Congress in March that it might droop the appliance of an esoteric banking regulatory instrument – assessing whether or not banking may hurt the financial institution’s fame – that critics of deboning had attacked.

Administration staff have mentioned numerous potential strikes with banking executives and regulators, together with the issuance of an enforcement order to the President on the topic and revival of A proposal From the primary time of Trump, which might power massive banks to supply “honest entry” to their merchandise, in response to two individuals who mentioned the problem with the administration staff however weren’t approved to talk publicly.

As an indication of how a lot the tide has shifted, the identical financial institution lobbying teams who’ve fought in a rule of honest entry in the previous couple of years have signaled that they might not have acknowledged in the event that they tried now.

Coal corporations and debt collectors

The debon dialog adopted after the monetary disaster in 2008, when the regulators adopted guidelines for the deterrent of banks from lending to threat enterprises.

Obama Administration Program, Operation Chocke Level, destroyed by financial institution accounts for some fee lenders and weapons enterprise.

Trump’s first administration minimize the Chocke Level initiative and Democrats additionally started to argue {that a} rash of Closing the Small Business Account It was proof that one thing wanted to be carried out to restrict debate.

On the finish of 2020, the Foreign money Controller Workplace, on the Brooks, stated that they had seen proof that the 5 largest banks in America – JPMorgan Chase, Financial institution of America, Citi, Wells Fargo and US Financial institution – had stopped offering banking providers to fossils.

In a single case it’s marked by the Prosecutor Normal for Wyoming, Wells Fargo website It advertises that the creditor will refuse the providers of coal manufacturing corporations. Since then, the Internet web page has disappeared and the WELLS FARGO spokesman has declined to make clear the financial institution’s present insurance policies.

However lately, different examples have been contested, typically cited by conservative media, such because the case of the indigenous inhabitants, Christian charity in Tennessee, energetic in Uganda. Charity with the assistance of a gaggle of non secular intercession, Alliance defends freedomHe filed a grievance to the Prosecutor Normal of the State in 2023, arguing that Financial institution of America apparently closed his account because the creditor disagreed together with his non secular views.

Financial institution of America firmly denied this, saying that the basis inhabitants’s advance was concerned within the assortment of debt and that the financial institution refused to serve such entities.

Jeremy Tedesco, a senior Alliance adviser to guard freedom, stated Financial institution of America didn’t give this purpose when she had closed the invoice, however had solely collected it 4 months later after the media started to write down concerning the case. One factor that isn’t contested: the Tennessee Normal Prosecutor doesn’t pursue the case.

Private challenge

For the Trump, the query appears each private and political.

First girl, Melania Trump, wrote in Her recent memoir That the financial institution had minimize her and the son of the couple Baron, though she didn’t cite any proof and her workplace refused to supply them. And in March the Trump Group filed a case against Capital One The Florida State Courtroom accuses the financial institution of “unjustified termination” of greater than 300 of its financial institution accounts after January 6, 2021, assaults US Capitol for “awakening” beliefs.

The capital spokesman denied that the financial institution had closed any accounts for political causes, however declined to supply another purpose to shut Trump’s accounts.

White Home spokesman Harrison Fields stated in an announcement: “The White Home, after all, offers with the unlawful abuse of energy by banking establishments and their regulators designed to eradicate conservatives from public life.”

The subject additionally enabled G -n Trump to reward the crypto business that claims to be actually debunking By regulatory situations the place banks can open cryptocurrency payments. The business says that these pointers make it troublesome to take part in even primary banking providers.

“

In an announcement, a spokesman for the Ministry of Finance, known as the Decanking “Ne American” and stated that Mr Bessent had requested the regulators to take care of the problem of a “threat of fame”. Some debaning critics say that banks shouldn’t be allowed to make use of this threat as an excuse to refuse banking providers to potential prospects.

“The Ministry of Finance stays dedicated to making sure that the banking system works with integrity and offers honest entry to Individuals.”

Senator Tim Scott, a South Carolina Republic, is a complicated invoice that seeks to instantly address the issues of debate. The principle financial institution lobbying teams help a invoice {that a} outstanding financial institution lawyer talking anonymously to keep away from indignant politicians known as “self -preservation train”.

The Federal Reserve additionally stated it was addressing the issue. On the finish of final month, the Fed withdrew directives that require banks to inform him earlier than doing a cryptocurrency enterprise – one of many extra hated cryptocurrency guidelines.

And in February, Central Financial institution Chairman Jerome H. Powell advised the legislators that he had eliminated the language from his regional reserve banks as to how they resolve which monetary corporations had been getting access to the Fed Cost System.

The rules on these essential accounts had beforehand known as on the reserve banks to “think about the habits of the establishment and its administration and whether or not the affiliation with the establishment was an unjustified fame threat.” He additionally raised the query of whether or not the establishment in query was engaged in “controversial feedback or actions”.