Anybody flipping by way of newspapers or enterprise TV channels this week might have seen two phrases on repeat: Jackson Gap.

They discuss with the most important central financial institution convention of the yr, which takes place on the finish of every August at Jackson Lake Lodge in Grand Teton Nationwide Park in Wyoming. This yr’s convention begins on Thursday and runs by way of Saturday.

To the uninitiated, it could appear unusual that what’s arguably crucial financial occasion on the earth is going down in distant Wyoming, two time zones away from the Washington-based Board of Governors of the Federal Reserve and 1,047 miles from its host, Kansas Metropolis Fed. And the symposium itself is hardly the common convention. Moccasins give approach to cowboy boots. Attendees munch on huckleberry pastries (or huckleberry drinks) whereas discussing the most recent financial articles.

But when Jackson Gap is a little bit misplaced, it is also undeniably necessary, an invitation-only gathering the place paradigm-shaping analysis is offered and necessary coverage adjustments are introduced. The occasion has lengthy been a Wall Road obsession.

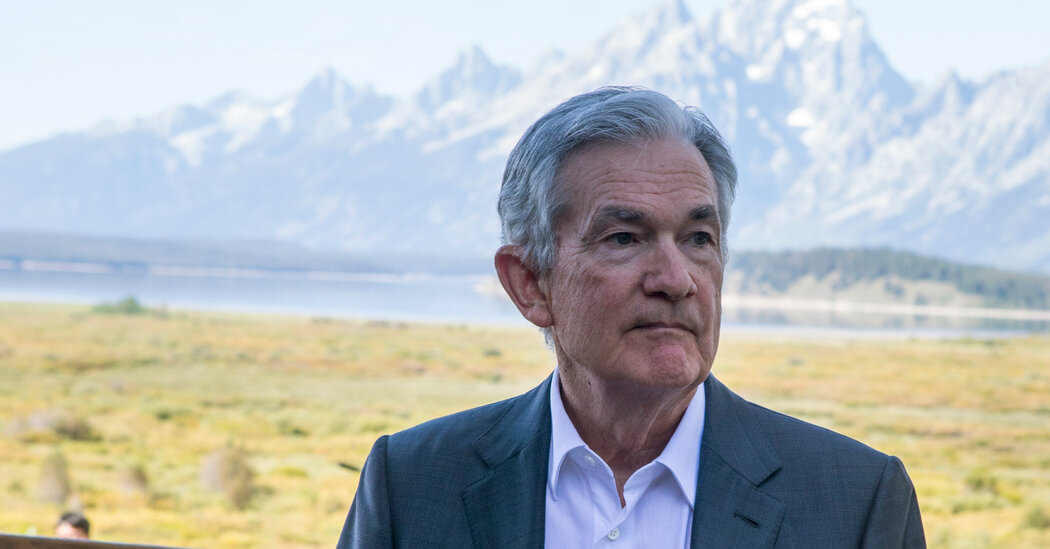

This yr will likely be no exception. Jerome H. Powell, the chairman of the Federal Reserve, is because of converse on Friday morning, and markets are eagerly awaiting his remarks for even the slightest trace of how a lot the Fed may reduce charges at its assembly subsequent month — and the way shortly central bankers will scale back borrowing prices thereafter.

Questioning how a financial coverage convention held on the finish of August turned such an enormous deal and why it stayed that method? Curious if this yr’s convention in Jackson Gap will matter for mortgage charges or the job outlook?

This is all the things it is advisable know.

They got here for fly fishing.

The convention is held in distant Wyoming partially as a result of the world gives good fly fishing.

The Kansas Metropolis Federal Reserve held its annual convention domestically for the primary time in 1978however within the early Eighties the organizers had been in search of a brand new location. The Fed system divides America into 12 areas and Grand Teton Nationwide Park sit up straight within the Kansas Metropolis space.

Then, convention organizers hoped that the Fed chairman on the time, Paul Volcker, can be coming to the occasion. Mr. Volker was an avid fisherman. Jackson Lake Lodge is near some noisy creeks. It was destiny.

With the beautiful backdrop of the Rocky Mountains and the presence of Mr. Volker, Jackson Gap got up quickly occasion of the yr by the Fed. Different reserve banks did try to download it: San Francisco “repairs this yr to the Monterey Peninsula,” The New York Instances reported in 1985, whereas the Atlanta Federal Reserve bid for “an unique Sea Island spot.”

However Jackson Gap received. Alan Greenspan speak at the conference in 1989, beginning a pattern during which Fed chairmen often appeared on this system — and making the symposium a key point of interest for the markets. At the moment, the occasion hosts a who’s who of worldwide economists and central bankers. The visitor record is comparatively small: lately it has averaged 115 to 120 attendees.

They stayed for the political information.

In reality, the Wyoming symposium has turn into much more related within the twenty first century, partially as a result of the Fed chairman typically delivers a significant coverage message in Jackson Gap. The convention is being held proper on the finish of the summer season, forward of the Fed assembly in September, making it an opportune time for these bulletins.

Mr Powell has a historical past of breaking information on the occasion. In 2020he used the convention to current the Fed’s new financial coverage technique. In 2021 he stated reasons {that a} model new burst of inflation might fade by itself.

And when inflation as a substitute proved cussed and the Federal Reserve started to struggle it by elevating rates of interest, he used his 2022 speech to vow that officers would keep it up till value will increase had been once more contained – even when it slows down the economic system in painful methods.

Powell’s speech is the primary focus this yr.

Up to now, the economic system has held up, though inflation has eased steadily and economists anticipate Mr. Powell to foretell that the Fed is prone to announce the beginning of rate of interest cuts at its September 17-18 assembly.

The Fed chairman might keep away from being extra particular than that, economists say – a key jobs report is due for launch on September 6, so he will not wish to commit the central financial institution too absolutely at a time when the outlook may change. The jobless fee jumped in July, a worrisome signal that has officers frightened that the job market could also be on the verge of cracking.

Given the information coming in, Mr. Powell might not reply Wall Road’s largest query: How briskly will charges fall? Merchants are betting the Fed will most probably make a traditional quarter-point fee reduce in September, whereas some anticipate a bigger half-point reduce, particularly because the labor market slows.

“He will say one thing that is clearly in keeping with a reduce,” stated Jan Hatzius, chief economist at Goldman Sachs. “However I do not suppose he will restrict himself to measurement.”

What the Fed chairman says may matter for jobs and mortgages.

What Mr. Powell says — and what the Fed does subsequent — may decide whether or not the economic system has a gentle financial downturn or a painful crash touchdown.

There are two main dangers.

If the authorities reduce rates of interest sharply to maintain the economic system from slowing down an excessive amount of, that would scale back the price of borrowing throughout the economic system, from mortgage charges to enterprise loans. This might enable demand to heat up once more. And whereas this might be a welcome improvement for companies and potential homebuyers, it may enable inflation to stay excessive if value will increase aren’t but absolutely contained.

But when officers transfer too slowly to chop rates of interest, the labor market may decelerate an excessive amount of, to the purpose that households forego spending and the economic system slips right into a recession—a tough financial touchdown.

Politics would be the elephant within the room.

Politicians care rather a lot about what the Fed is doing — particularly in an election yr. Nobody desires to inherit a recession. And sitting presidents favor low rates of interest that irritate markets and the economic system.

However the White Home has no direct management over Fed coverage. Presidents appoint the Fed’s seven-member board in Washington, together with the Fed chairman, however these officers should be confirmed by the Senate. And as soon as they’re in place, the staff are isolated from politics and free to set coverage as they see match.

Nevertheless, that does not cease elected officers from speaking in regards to the central financial institution. Former President Donald J. Trump, the Republican nominee, has a historical past of commenting on Jackson Gap particularly.

When he was in workplace in 2019, Mr Trump posted on social media instantly after Mr Powell’s speech in Jackson Gap, asking who was “greater enemy” — Mr. Powell or Xi Jinping, the chief of China.

And already this yr, Mr. Trump has made a behavior of speaking in regards to the Fed since his marketing campaign, saying or implying that it could be political if he reduce rates of interest earlier than the election, at one level saying that presidents ought to I have the floor in financial coverage (a declare he later played).

Central bankers say they ignore each coverage speeches and elections when desirous about rates of interest.

“They simply do not get dragged into this muck,” stated Julia Coronado, a former Fed economist and founding father of MacroPolicy Views, a analysis agency. Plus, a transfer in September is unlikely to have an effect on the markets or the economic system sufficient to be decisive.

“I do not suppose the presidential election is received or misplaced on decreasing or elevating rates of interest,” she added.