In Instagram emissions, Martini glasses cling to what seems like an limitless cycle. A Nights Out picture carousel present low -lit stachaus, tartare and souffle, luxurious cherries. (What on this financial system screams the cherries of luxurious?) The random colleague of the roommate is someway settled on one other cable in one other tropical swimsuit. (Who owns these many swimwear?) The random roommate of an affiliate of a colleague is inexplicably assessments a brand new toilet with Bitcoin.

With only one click on, the information is: Tariff Flip Flip, which may hit the iPhone, T-shirts, backpacks and toothbrushes. Available on the market charts in the marketplace charts and gloomy tv information, there’s a wild zigzag of crimson strains with panicked voices, which communicate of retirement financial savings, which causes anger even for folks from retirement.

“Telephone-eats-first meals kind, no matter viral sweater I tour Tiktok, the brand new work bag,” says 25-year-old Devin Walsh, who lives in New York and works in advertising and marketing, itemizing the tempting purchases that fly over her Instagram, even cussed final week. “In the meantime, everybody refers back to the nice melancholy.”

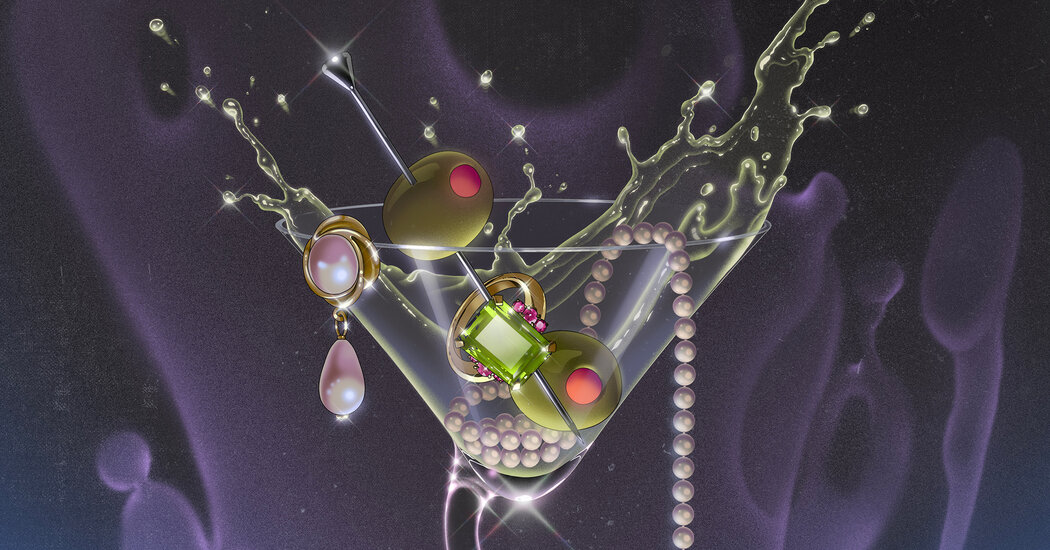

This can be a dizzying time to be 20-something, flooded with social media emissions that blink different folks’s travels and restaurant reservations that really feel extra hosted than ever, due to what the tendencies of the forecasts name “growth aesthetics”. This can be a latest embrace, of trend labels, influencing and odd march, of lavish consumption of previous cash, comparable to fits impressed by Gordon Geko and endless (once verbatim) skinsS

Many younger individuals are struck by anguish of financial self -awareness, telling buddies or therapists that they can’t sustain with Jounes (and what Joenes are posting on Instagram). Others compete to save lots of after which make pulse purchases that permit them really feel anxious or responsible, who spend a hangover from a pair of footwear “Oh, not.”

“You see a social media publication and you’re like,” Perhaps I am doing one thing improper, “says 27 -year -old Veronica Holloway, an information analyst who lives in Chicago. “Simply as I needs to be irresponsible if I am unable to spend like that.”

The anxiousness obtained results in what monetary planners name “cash dysmorphia”. The Bridal Dysmorphia brothers, which suggests individuals who look within the mirror and don’t see what there’s, is about individuals who have a distorted view of their very own monetary effectively -being. That is the thoughts bending with a cut up display of actuality.

“You’re able the place you don’t consider you find the money for, although the numbers say you’re effectively,” says Aja Evans, a monetary therapist with some purchasers who’re combating dysmorphia. “It’s simple for folks to create a narrative about what they see on-line – they’re like,” Oh my God, all of them go to the spring trip, I am the one one who stays at dwelling. “

These perceptions, blurred by actuality, result in some to restrain themselves for pointless spending. This may result in different folks, generally activated by “Purchase Now, Pay Late”; The Consumer of the Center Gen Z has roughly $ 3,500 bank card debt, in accordance with Experian information. A 2024 survey Carried out by Qualtrics discovered that nearly one -third of all People reported that they have been feeling dysmorphia, together with 43 % of Gen Z.

For G -Ja Holloway, this worrying uncertainty about prices started in childhood after each her mother and father misplaced their work within the monetary disaster in 2008. Her household lived underneath the poverty line, she mentioned. D -Ja Holloway thought twice about even the mandatory prices. When she purchased a pair of $ 130 sneakers for her highschool crew, she spent every week feeling sick in her abdomen.

She has by no means been capable of utterly shake her worries, even now that there’s a wage that’s greater than coated the lease and dishes. It doesn’t assist that her social media act as a highlighted reel of the prices of buddies, from intrusive dinners to acrylic nails.

What is named Hemline’s concept says that when the financial system turns into stronger, the lengths of the skirts develop into shorter; Increase occasions imply that individuals need to social gathering. The consequence that some economists and sociologists have found is that when the financial system turns into down, it tastes like small luxurious, generally they develop. Through the 2008 monetary disaster, some scientists reported Seeing the “lipstick impact” that buyers spend extra on small beauty objects, maybe as a approach to really feel a bit of higher for the state of the world or no less than for his or her faces. And within the early Eighties, when the financial system transferred, trend turned nasty and overhang. One in style Poster Sometimes has been exhibiting a person in a tweed jacket and English pants leaning on a curler roye, a cocktail glass within the air.

“This Preppy-style wealth got here in the course of the worst financial recession of the Thirties,” says Douglas Rosinov, historian and creator of the Reagan Age.

This tendency for lipstick prices, adopted with a disaster, is layered on a monetary actuality that’s already complicated for younger folks. For years, millenniums have lived with a distorted sense of economic safety due to cash from danger capital, basically subsidizes the provides of Doordash and Uber Rides. Social media invite folks to publish solely their hardest reservations for dinner and White Lotus -Reminiscent Journey. Now the financial image is especially unsure, and Instagram’s aesthetics is very luxurious.

“There was this extra muted, minimal norm of 2010, the place folks tried to clog their power or wealth-which got here out of the Silicon Valley and its careless method to the workplace-which fell to the profit,” mentioned the prediction of Sean Monahan’s pattern.

D -n monahan who uncovered the time period ‘Aesthetic boom“In December, he adopted a latest soar in Flashy Finery: Caviar Fumps, Vast Costumes, Chateau Marmont Celebration, the 1980-style decline.” Individuals really feel within the standing video games very explicitly, “he mentioned.” The social hierarchy is within the move. “

Desi Dimino, a know-how employee, notices when buddies publish photographs from ski resorts and music festivals. She needed to strengthen her voice in her head, reminding her to save lots of, as she adopted titles for financial uncertainty and tariffs that appeared to hit her every day bills, together with groceries comparable to espresso beans and chocolate.

“I do not simply need to cease doing all the things, however I do know there are days that I actually need to chew the bullet and keep dwelling,” mentioned Gi Dimino, 27 years previous.

For Mrs. Walsh, a New York advertising and marketing worker, attracting prudence feels particularly difficult for her era due to the shared sense that they reside underneath a cloud of steady crisis-Covid-19, local weather change, political turbulence. Typically she tells her mom that it’s troublesome to assemble self-discipline to save lots of when she continues to listen to that the sky is falling.

“We usually tend to spend severely due to this coming vitality of the principle character of” The world will finish anyway, “mentioned G -Ja Walsh. “What will we save?”

In February, she fell aside on the Valentine’s Valentine’s family in her hellish kitchen house, spending a whole bunch of coronary heart -shaped sun shades to the wall to really feel like a sun shades, a sink stuffed with alcohol and a brand new $ 150 costume. “Was the usage of funds rational?” she mentioned. – Perhaps not.

Monetary planners, particularly those that work with younger folks, try to assist purchasers who really feel transferred from these financial modifications. A few of these clients purchase new blazers and holidays as a balm for his or her wider sense of tension about the place the financial system is directed. Others keep away from even cheap purchases.

“I work with somebody who has began to get out of grocery, though her household’s monetary future doesn’t hold when touring to Complete Meals,” says Mat Lundquist, a therapist in Manhattan. “The reverse finish is that individuals are rather more happy to be searching for – getting the Chanel bag,” Oh, overlook it, I wished these footwear. “

Kara Perez, who based a company that trains ladies to handle finance, noticed that this uncertainty reshapes the views of its purchasers in school. Some are overwhelmed by the wealth they see on social media, and this makes them lose the sensation of being financially comfy or not. Pere Perez mentioned that some clients she would describe as a firmly center class are not seen that approach.

“Many individuals are like,” I am not Kim Kardashian, I am not Elon Musk, that is why I am damaged, “mentioned Perez.

Pere Perez additionally sees this temper within the feedback that customers depart on their social media web page. To Tiktok, the place G -ja Perez calls herself a private skilled in finance, she forgives those that reply to her publications towards the background of chaos of the second, successfully saying: “There isn’t a level in saving a babe, we is not going to retire. It’s good to spend extravagant now.”